Dynamic 3D Secure

Overview

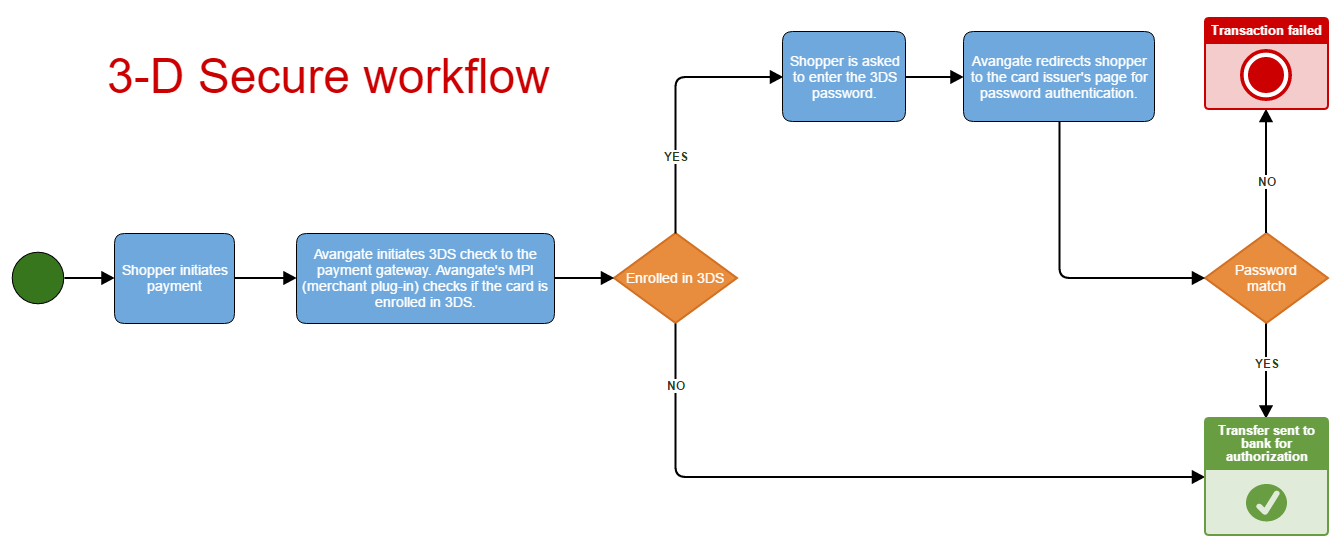

3D Secure is a system designed to increase the security of online transactions using cards by checking customer identities before allowing them to finalize a purchase. 3D Secure works by redirecting customers to pages provided by their banks, where they need to enter additional security tokens or password to trigger the completion of the charge. By using 3D Secure, you get additional protection from liability for fraudulent card payments, with customers having to go through an extra layer of authentication.

Description

Dynamic 3D Secure is based on the 3D Secure service offered by Visa and MasterCard, which is an additional security layer for authenticating cardholders online. 2Checkout uses Dynamic 3D secure to bring increased transaction acceptance levels on a per-country basis and extra protection against fraudulent purchases.

Availability

All 2Checkout accounts.

Dynamic 3D Secure workflow

Based on a set of specific filters and corresponding thresholds, 2Checkout enables or disables 3D Secure in real-time for online transactions. This approach provides a seamless payment experience for low-risk shoppers and optimized conversion rates for your business.

The filters used to determine whether or not 3D Secure should be enabled include:

- Card issuing country

- Billing country

- IP country

- Transaction amount

2Checkout enables 3D Secure for transactions which it evaluates and flags with a high degree of risk, based on specific filter thresholds. Safe transactions go through without 3D Secure.

2Checkout also offers the possibility to disable 3D Secure for all transactions in a specific country, bypassing all the filters. Contact 2Checkout to inquire about switching off Dynamic 3D Secure for your account.

Benefits

2Checkout uses Dynamic 3D Secure to bring increased transaction acceptance levels and extra protection against fraudulent purchases. The added value Dynamic 3D Secure brings to the table consists in real-time transaction evaluation methods that determine whether or not 3D Secure should be enabled.

Dynamic 3D Secure improves the overall shopping experience on multiple levels:

- Increased authorization rates - tests have shown that 3D Secure can have an overwhelmingly positive impact in specific countries.

- Mitigated fraud risks - using 3D Secure for risky transactions decreases fraud rate.

- Fewer chargebacks - the use of 3D Secure can reduce the number of chargebacks in situations such as fraudulent or unrecognized transactions.