APM POS

Introduction

Verifone has developed in-store payment solutions to enable its clients to accept global and domestic Advanced Payment Methods (APMs) on devices in the United States and across Europe. Advanced payments are traditionally QR code-based payments, where a consumer scans a QR code presented to him/her at a merchant. Upon scanning, the transaction routes outside of the traditional card acquiring and authorization rails and is authorized by the advanced payment provider.

Global APMs

Global APM solutions are offered across multiple markets while domestic solutions cater to consumers in specific countries. Global APMs include Alipay, WeChat, Klarna, and PayPal along with other QR code-based payments. Verifone has written integrations to the various APMs and acts as a processor and acquirer, routing transactions over “Verifone’s rails” to the APMs and receiving the money from the APMs and settling the transactions to the merchant. This means that as a merchant you shall have an account with Verifone where funds from your APM transactions processed through Verifone are deposited in. Verifone will pay out to your bank account from the Verifone account.

Regional APMs

Verifone has also created processing rails by integrating to regional advanced payment methods in the Nordic countries including Vipps, Swish, and MobilePay.

APM Providers

Below is a description of the different types of Advanced Payment Methods that cater to different consumers.

Cross Border APMs

Alipay and WeChat are cross border APMs. They are based on lifestyle apps that offer consumers a broad range of other financial and non-financial services (such as investing, sending money to friends and family, and social media) in addition to enabling instore and online payments. Alipay & WeChat are used primarily by Chinese tourists and local Chinese residents. Alipay & WeChat Pay are more ubiquitous in China than traditional cards. As a result, when Chinese tourists travel outside of China, they are limited to the local currency they can convert and the limited balance that they carry on credit cards used primarily for foreign travel. As a result, seeing the Alipay & WeChat pay acceptance sign at merchants outside of China is a sign of relief and trust.

Alipay & WeChat can either use a card or bank account as a funding source. These APMs also allow customers to maintain a balance. Unique to Alipay and WeChat, is that users can spend up to $50,000 on a single transaction. As a result, merchants that accept Alipay and WeChat are seeing higher than average transaction levels from Chinese residents and Chinese tourists than transactions made with cash or cards, which makes the prospect of offering these APMs attractive. Chinese tourists and residents appreciate that paying with Alipay or WeChat enables them to better manage their money and have more flexible spending.

Alipay and WeChat are wildly successful in China, boasting 1 billion and 900 million accounts, respectively.

For an Alipay or WeChat consumer account to support payment functionality, it must meet the following criteria:

- Account must be tied to a local (Chinese cell phone account).

- Account must be verified through Know Your Customer by Alipay and WeChat Pay (consumer provided Chinese government-issued ID to the scheme).

- Account must be tied to a source of funds in China.

Peer-to-Peer Applications

Many applications like PayPal, Venmo, Vipps, Swish, and MobilePay have become successful as peer-to-peer payment applications for young people to send money back and forth among friends or from parents to kids. While these peer-to-peer applications have successfully captured many users, they are for the most part not profitable. The peer-to-peer payment providers are now looking for Verifone to enable in-store, in-app, and e-commerce acceptance for these apps. Consumers also want to leverage the money they have sitting in these wallets by spending it directly from the wallet rather than having to move the money to another account and then withdraw the funds.

Domestic Flexible Spending or Split Payments

Buy now and pay later, or split payments have become very attractive to young consumers who are credit card averse due to the high-interest rates that traditional cards charge, but would still like a way to purchase more expensive items, and have the cost split over several installments that match their salary pay cycle. Klarna is not a traditional payment scheme, such as Alipay or WeChat. Klarna allows for domestic flexible spending or split payments. Younger consumers, millennials, Gen Z-ers may have debit cards but are less interested in credit cards or store-branded cards and the expensive charges applied if the full balance is not paid at the end of the month. Advanced payment methods such as Klarna enable consumers to defer payments to later in the month or split the payments over several months to afford more expensive items. This allows younger consumers to buy higher-priced items and/or add extra items to their baskets. Merchants are seeing higher revenues by accepting split payments.

Klarna offers consumers several payment options depending on the country, such as: direct payments (pay now), pay after delivery (pay later), split payments on your card over several weeks/months (pay-in-3, pay-in-4); and installment plans (financing).

Although Klarna provides credit to consumers, Klarna will settle the full amount of the transactions to Verifone minus fees, who will in turn settle the merchant. This means that neither Verifone nor the merchant is providing credit to consumers. Consumers pay Klarna back based on the payment product the consumer has selected.

Klarna bases the credit and payment product options offered to consumers on two factors: the consumer information they are able to collect during a payment transaction and validate against a local credit bureau or agency, and cookies left on the consumer’s device and/or Klarna app from previous purchases.

|

Payment product |

Definition |

Market Coverage |

Typical basket |

|

Pay Now |

Instant payments with online bank transfer (Sofort) or direct debit. |

Sweden |

+$5 |

|

Pay Later |

Deferred payment via invoice with a 14 day delay. This allows consumers to make purchases towards the end of their pay cycle, where they may be low on funds |

Sweden, Norway, Finland, Denmark, Germany |

Up to $250 |

|

Pay-in-3, Pay-in-4 |

Consumers pay in 3 or 4 interest-free installments, auto-debited from debit/credit card, allowing them to spread payments out over time with no fees and in synch with their pay cycle. |

Pay-in-3: UK Pay-in-4: US |

From $250 up to $800 |

|

Financing |

Long-term installments of 6, 12, 24, or 36 months with flexible or fixed rates to help customers with larger baskets. |

All markets |

More than $800 |

APM app & APM cloud service

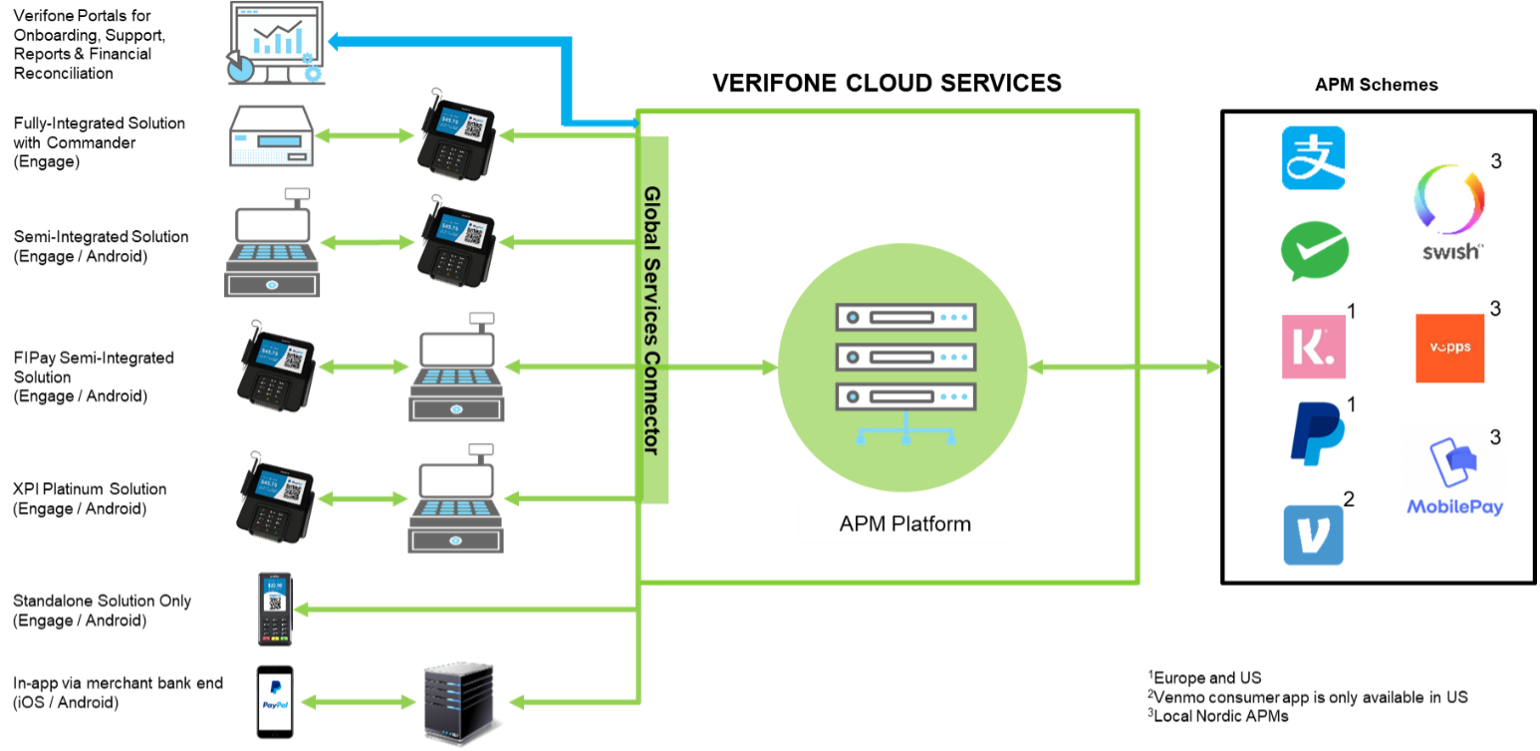

Verifone’s APM service consists of 4 basic elements; 1) the payment terminal that supports APMs, 2) a trigger-enabled payment application, 3) an APM app for each APM scheme, and 4) Verifone’s cloud-based APM service

- Payment terminal: The terminals that support APMs are listed below:

|

APM |

Service Model |

Coverage |

Terminals |

|

Alipay |

Acquiring |

North America, Europe |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

|

WeChat Pay |

Acquiring |

North America, Europe |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

|

Klarna |

Acquiring |

North America, Europe |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, 280s, e285; Android CM5, M424, M440, T650p, T650c |

|

PayPal

|

Acquiring or transaction processing |

United States, Europe |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

|

Venmo (Currently in development) |

Acquiring or transaction processing |

United States |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, 280s, e285; Android CM5, M424, M440, T650p, T650c |

|

Vipps |

Transaction processing only |

Norway |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

|

Mobile Pay |

Transaction processing only |

Denmark, Finland |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

|

Swish |

Transaction processing only |

Sweden |

Engage V200c, V240m, P400, M400, V400m, V400c, e280, e280s, e285; Android CM5, M424, M440, T650p, T650c |

- Trigger enabled payment application: includes, SCA4.0, Fipay with XPI Platinum (V19), XPI Platinum (V19), Vepp, Vepp+, and Vepa Platinum. All these applications need to ensure that they are running a version of Verifone’s ADK that supports APM triggers and APM apps.

- An APM app: each Verifone APM has a separate app. Only Engage, Android, and trinity are able to power and process the APM apps.

- Verifone’s cloud-based APM service: Verifone is routing all APM transactions from the APM app on the terminal through the respective APM service in Verifone’s cloud, and then on to the APM scheme for authorization.

Environments

Verifone has 2 environments for clients:

- Sandbox: Verifone has a sandbox available for merchants to test the individual APM services as well as test the commands and responses to sales and refunds, along with other transaction use cases to facilitate integration with the merchants back end systems including point of sale. Equally, Verifone has a sandbox environment for the portal associated with the APM services.

- Production: Verifone’s production environment processes sales and refunds that move money from the account holder to the merchant.

Technical support

Please view the support page and find your local support teams.

Finance support

Verifone will assist the merchant with finance-related inquiries, including verification of settlement amounts, returns, disputes, and retained fees. While help desk employees will assist merchants with general finance-related inquiries, if an issue requires further investigation, the case should be escalated to the finance queue. For any financial issues in North America, please submit all inquiries to: i.apm.finance@SMOKESTACK.VERIFONE.com.