W-8 and W-9 fiscal forms

In order to be compliant with the fiscal regulations in the United States, our merchants need to have the W-8/W-9 forms agreed and digitally signed.

What is the W-8 form?

The W-8 form is an Internal Revenue Service (IRS) form that is used to exempt non-US residents from submitting U.S. tax return reporting. Merchants that are registered outside the United States, but that run financial operations in US dollars are required to fill in and sign this form. These merchants (businesses or individuals) are not subjected to standard taxation practices as their investment income is not taxed.

The W-8 form is submitted by merchants only to financial companies that request it (payment processors like 2Checkout) and not directly to the IRS. Merchants that fail to submit the W-8 form can incur a 30% tax withholding and additional penalties.

Who does the W-8 form apply to?

The form applies to non-US residents, namely to foreign entities (foreign individuals or corporations) and exempt foreigners who are neither U.S. citizens nor reside in the US.

There are a variety of W-8 forms and if you are not entirely sure which one applies to you, visit the IRS website for more information.

What is the W-9 form?

The W-9 form is an Internal Revenue Service (IRS) form, also known as a Request for Taxpayer Identification Number (TIN) and Certification form, that is used solely to confirm a person’s taxpayer identification number (TIN).

Any corporation that is required to submit a 1099 form with the IRS must obtain and confirm your correct TIN to report any taxable earnings that may require you to submit a federal tax return.

The TIN holder is responsible for paying all the required taxes based on earnings reported in the provided W-9 form unless the taxpayer is subject to backup withholding. If this is the case, the W-9 form will have to include all the related details.

Who does the W-9 form apply to?

Individuals (merchants) who have US citizenship or reside in the US or entities (corporations and companies) registered in the US are required to fill in and sign this form.

Signing the W-8/W-9 forms on the 2Checkout platform

All merchants signed under Avangate Inc. or 2Checkout Inc. are required to fill in and digitally sign the W-8/W-9 forms and submit them to 2Checkout. Follow the steps below to sign the fiscal forms.

- After the onboarding process is completed and your account is approved by the Underwriting team, you (merchant) need to fill in the fiscal compliance form that applies to you (either W-8 or W-9). If your account has not been approved yet by the Underwriting team, you will notice that your account is in RESTRICTED mode until you finalize the submission of the required fiscal forms.

This form can be filled in only by the master account that belongs to the account holder.

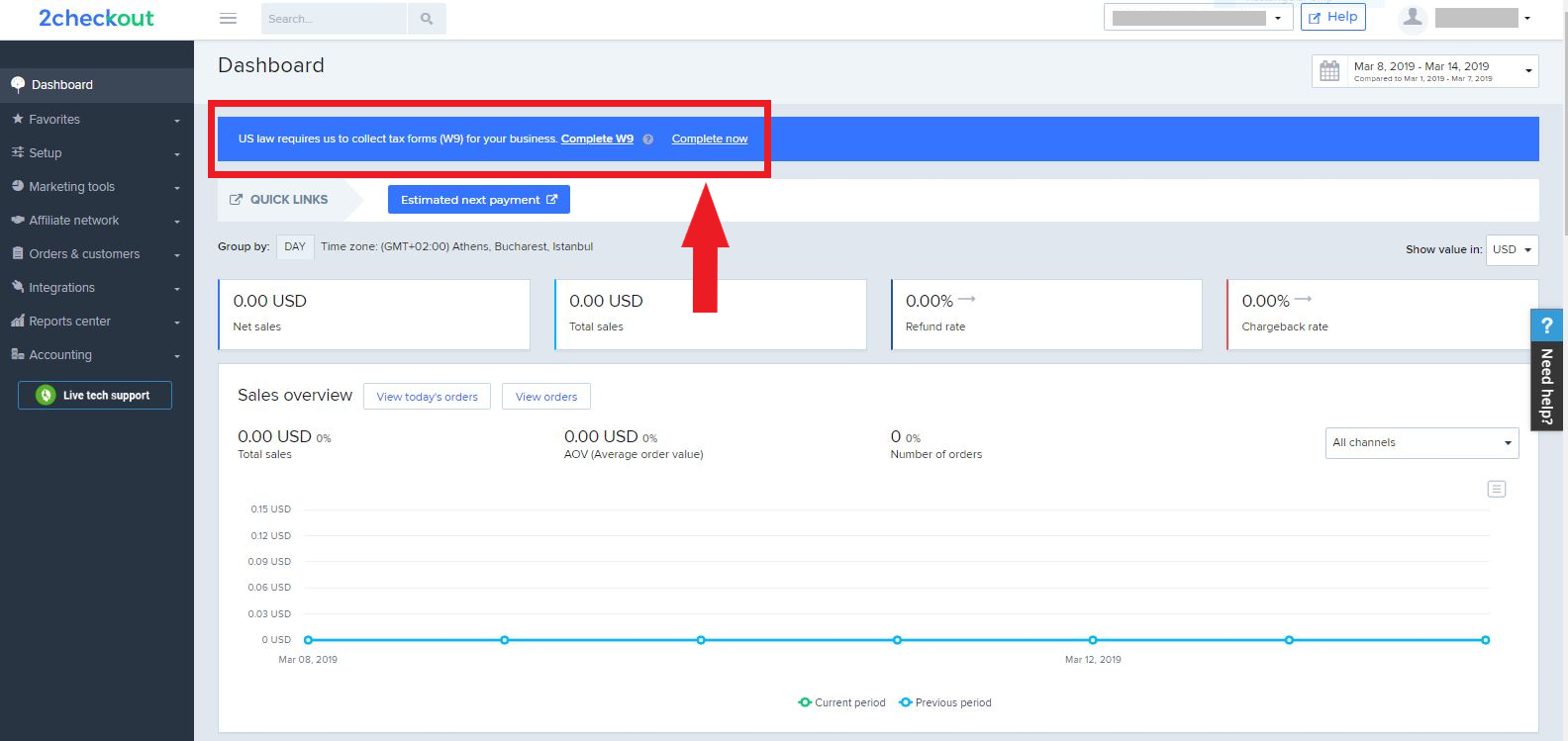

2. To sign the W-8/W-9 forms, log in to your master account in the cPanel and click on the Complete now link.

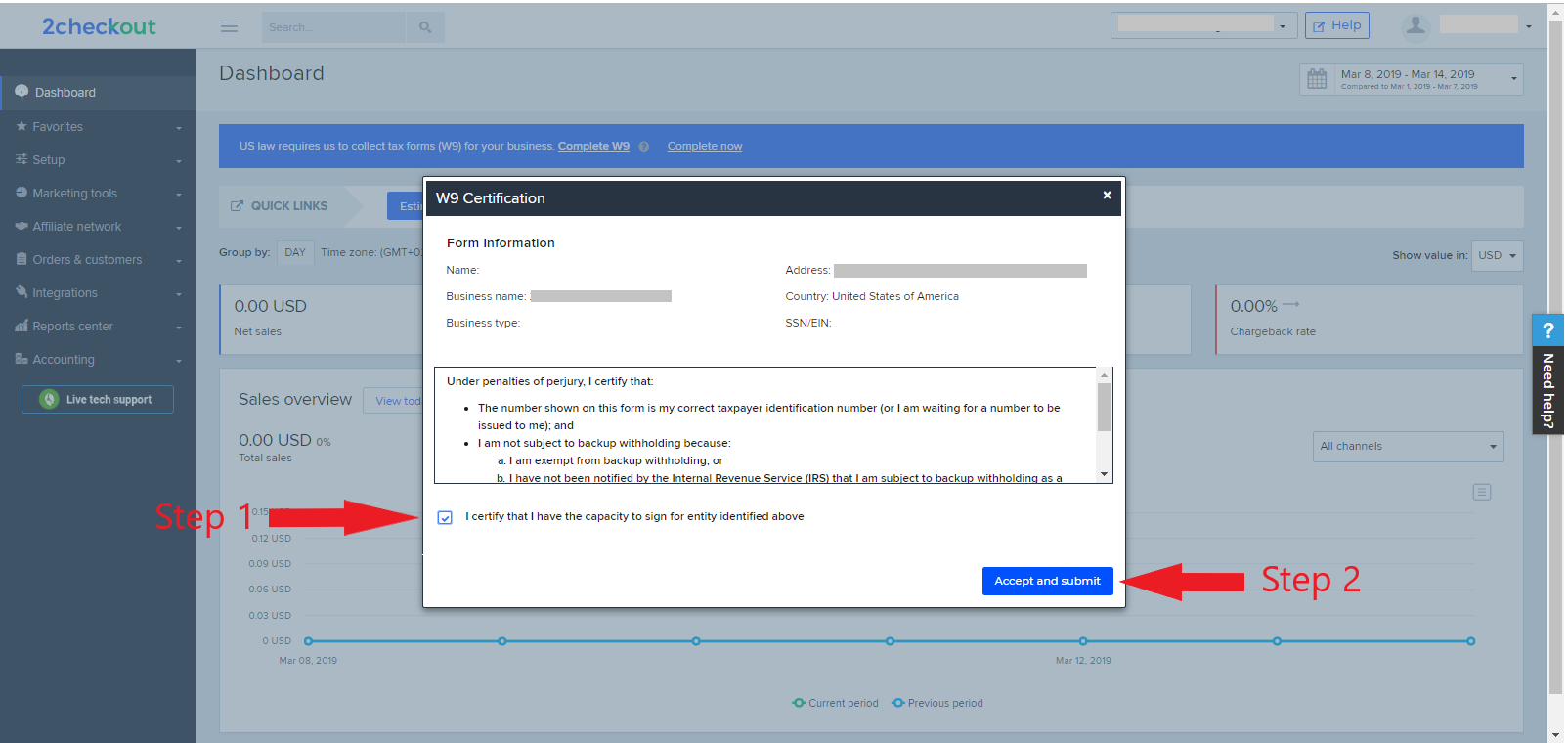

3. Before submitting the W-9 form, make sure that all the personal and company information you provided is correct. If you notice that some of the information is not correct, contact supportplus@2checkout.com to help you make the necessary changes. Note that any detail changes in the Control Panel (Access the user settings, Account information, Edit account information) will automatically invalidate the forms.

4. Select the I certify that I have the capacity to sign for entity identified above checkbox and then click on the Accept and submit button.

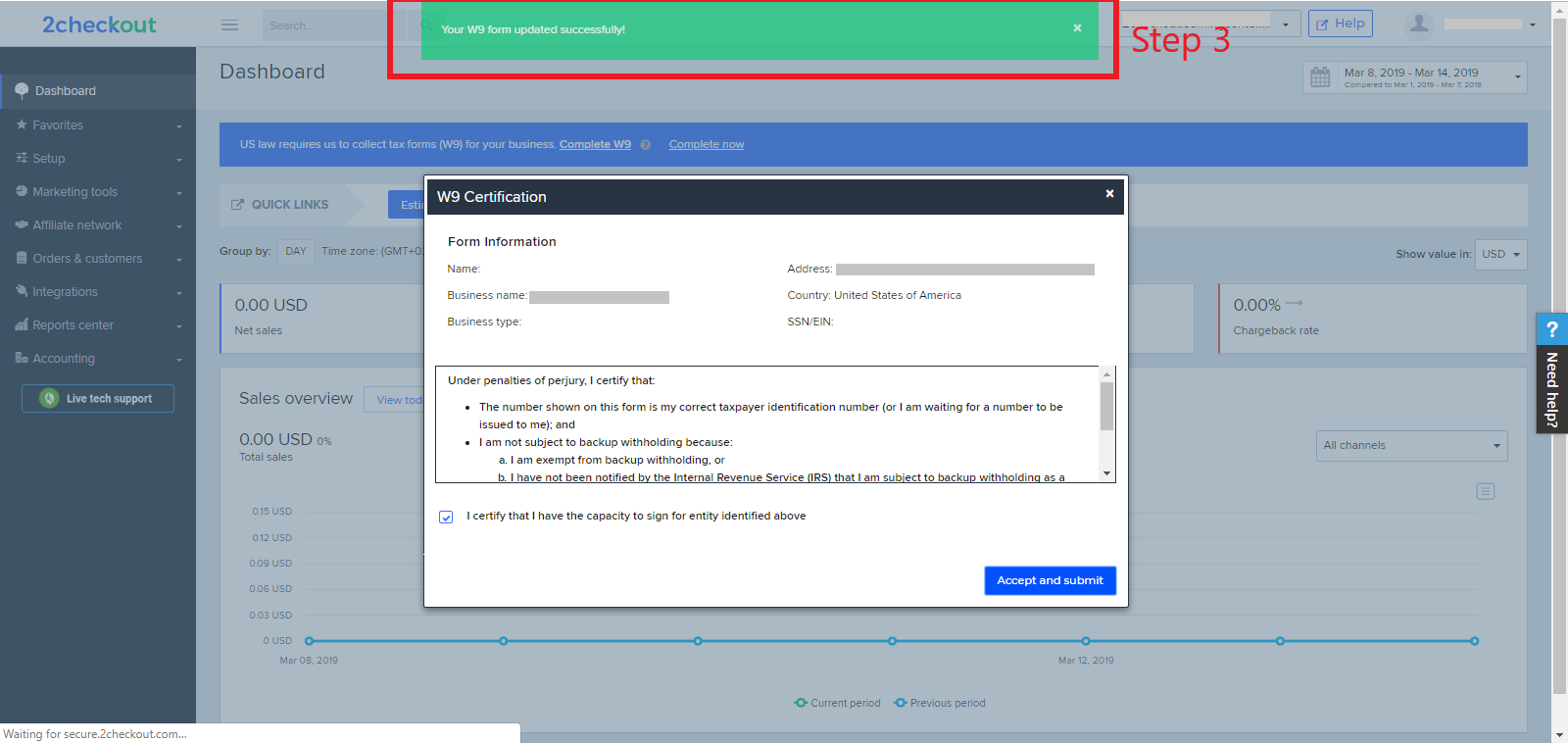

5. After submitting the form, a message will be displayed on top of the page informing you that form was successfully submitted, as shown in the image below.

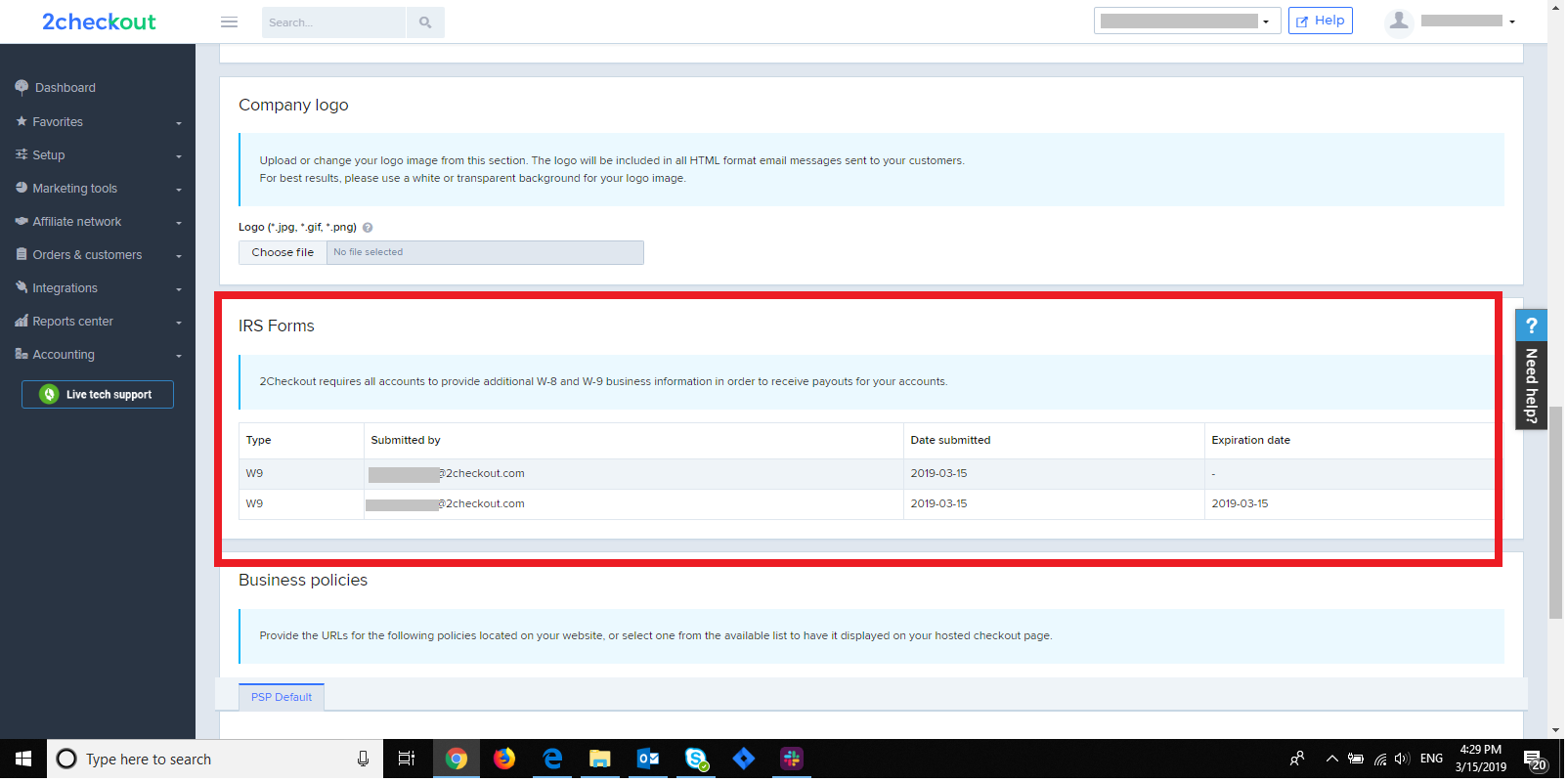

6. To access your W-8/W-9 forms and to verify you have submitted them, navigate to Settings → Account information → Edit account information → IRS Forms section.

7. After submitting the fiscal compliance form, you will become fiscal compliant and your account will be displayed as ACTIVE.

FAQs

- How long will my account be Restricted with reason code 406 Fiscal Sign?

Your account will be in Restricted mode until you’ve accepted, signed and submitted the fiscal forms.

- How many notifications to sign the forms will I receive?

You will receive a notification once a week.

- What happens when the forms expire?

Your account will be put in Restricted mode with reason code 406 Fiscal Sign and the notification process will restart.

If you need additional information about this law you can read more details on the IRS website.