Account identity verification

Overview

2Checkout complies with regulatory obligations worldwide and is committed to providing a secure platform for all our customers. This is why we are asking you to confirm your identify and provide proof of ownership of your company.

Account identity verification is a process referred to as "Know Your Customer" (KYC). We have simplified the process of supplying all valid, relevant documents, which should take you only a few minutes, and we appreciate your cooperation when it comes to verifying your information and reducing risk.

Requirements

Provide scanned copies of valid, relevant documents (i.e., do not include expired documents).

Workflow

For new accounts

1. Sign-up for a 2Checkout account.

2. Navigate to the Know your customer area and upload scanned copies of relevant documents from the checklist in this article. This will accelerate the review process and you can start selling and accepting transactions from customers worldwide.

3. Newly created 2Checkout accounts undergo a review.

4. Work with the 2Checkout underwriting team to help validate your information.

For existing accounts

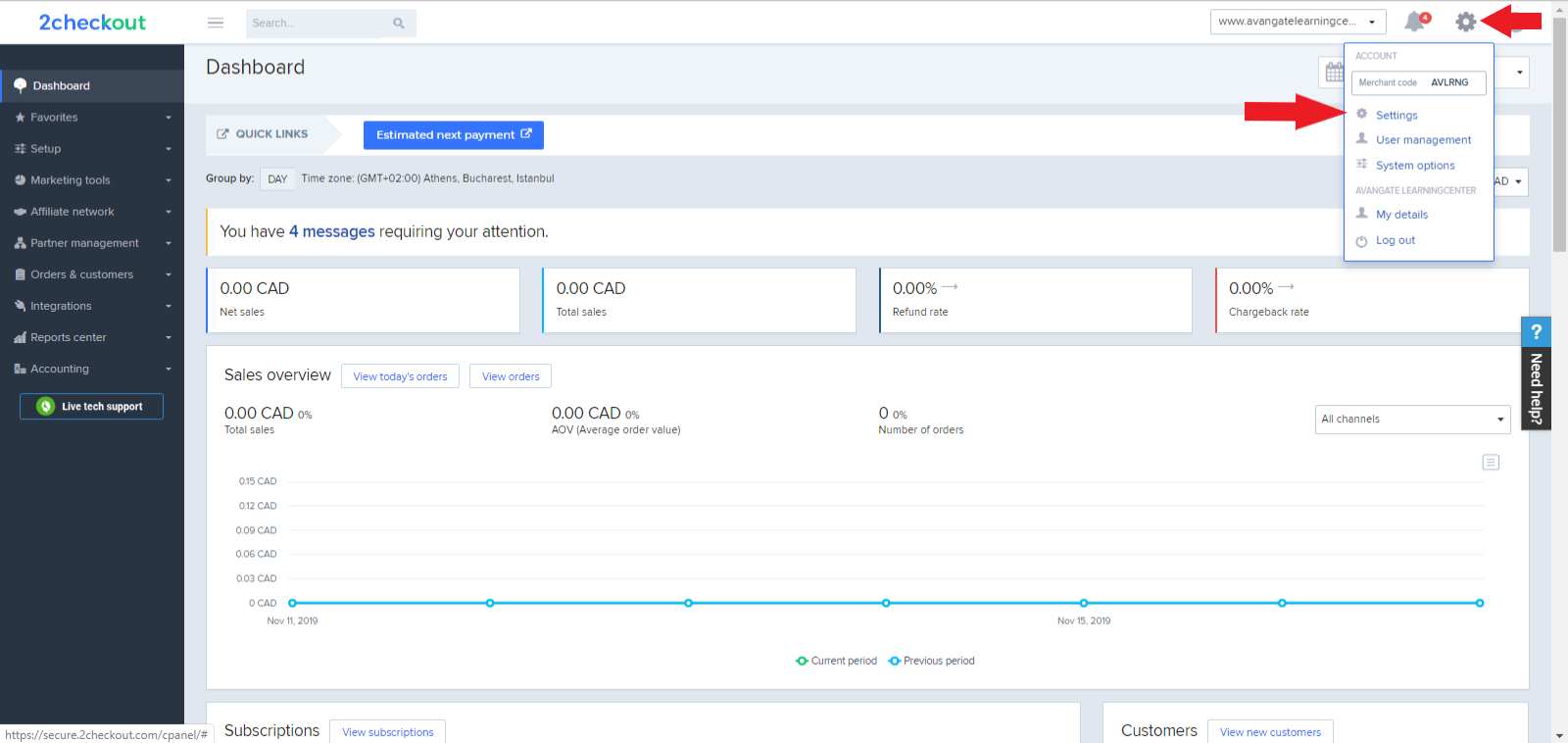

1. Log in to your Merchant Control Panel account.

2. Navigate to Settings in the upper right corner of your Dashboard, as shown below.

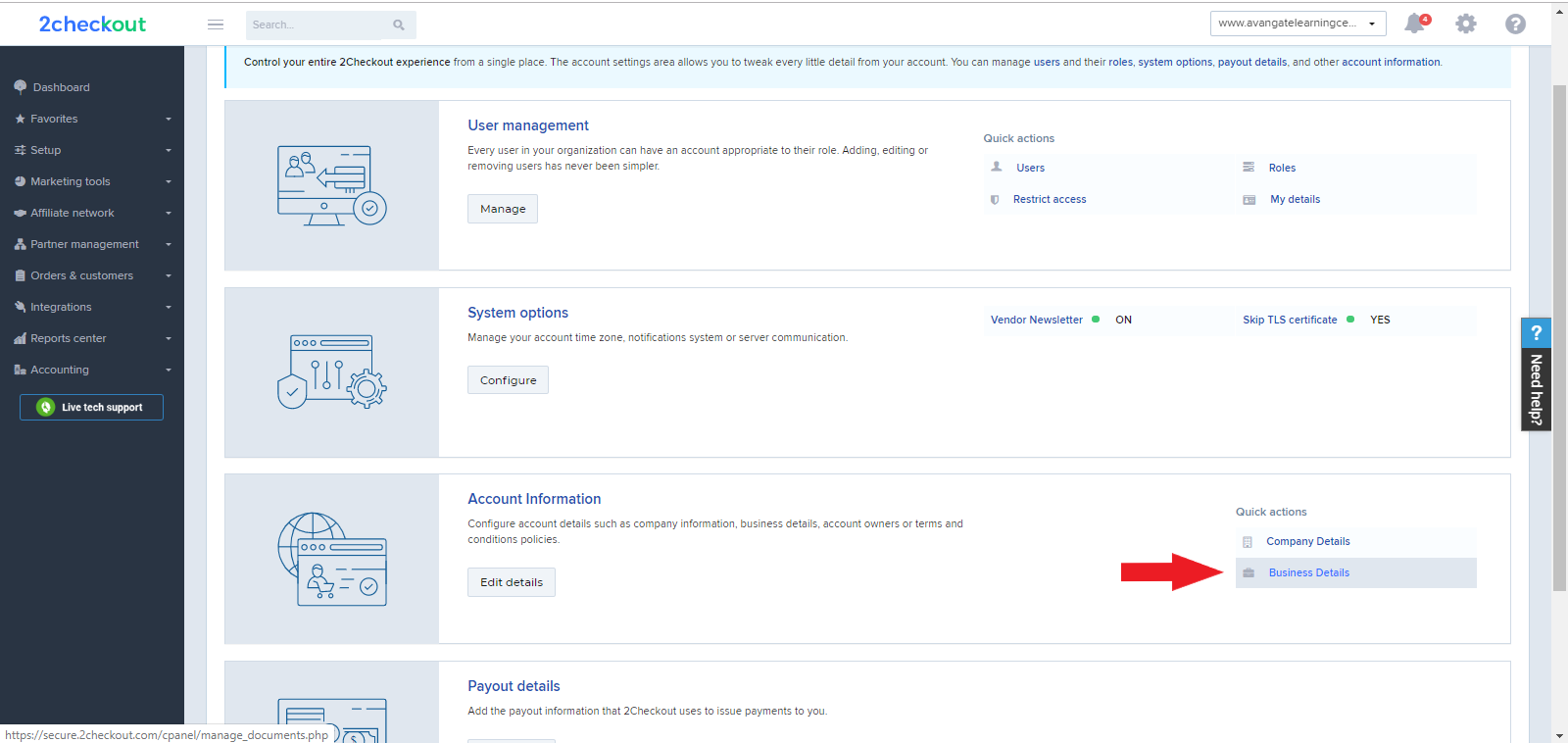

3. In the Account Settings window, scroll down to the Account Information section and click on the Business Details link, as the image below shows.

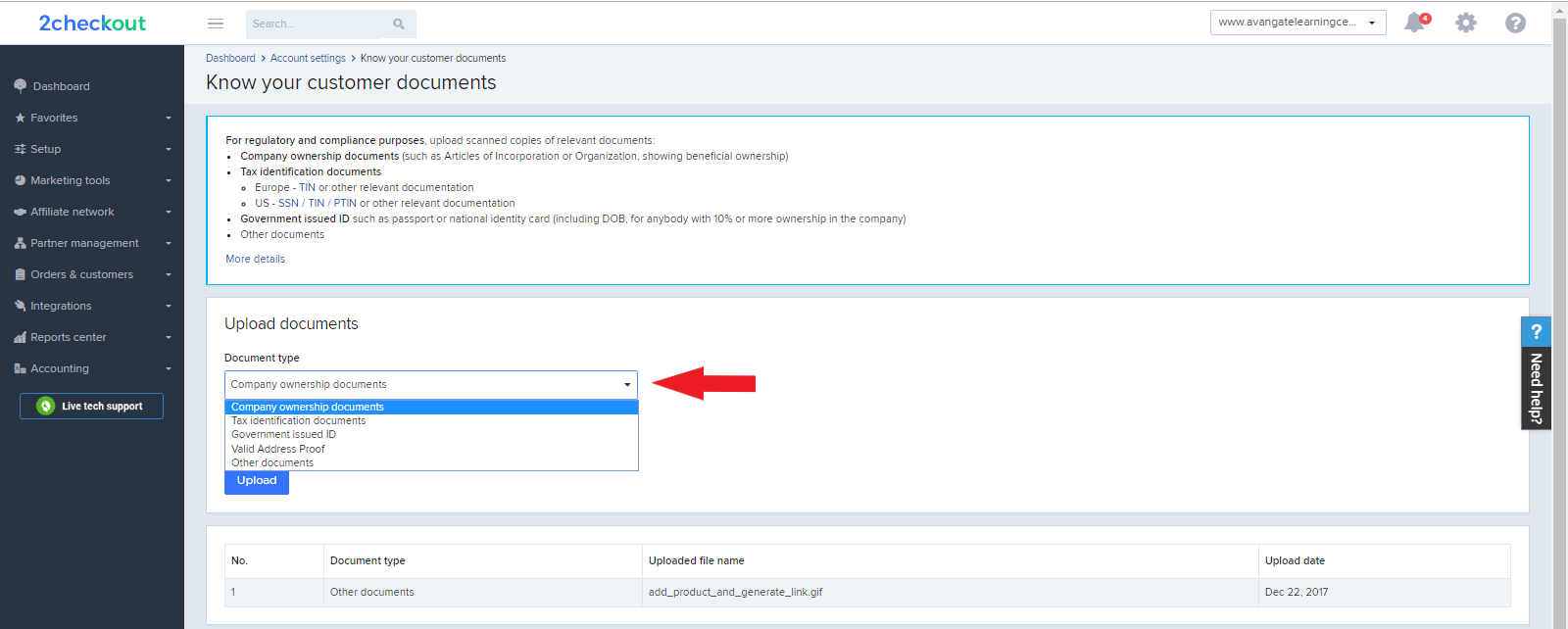

4. In the Know your customer documents window, scroll down to the Upload documents field and select the type/types of documents you want to upload.

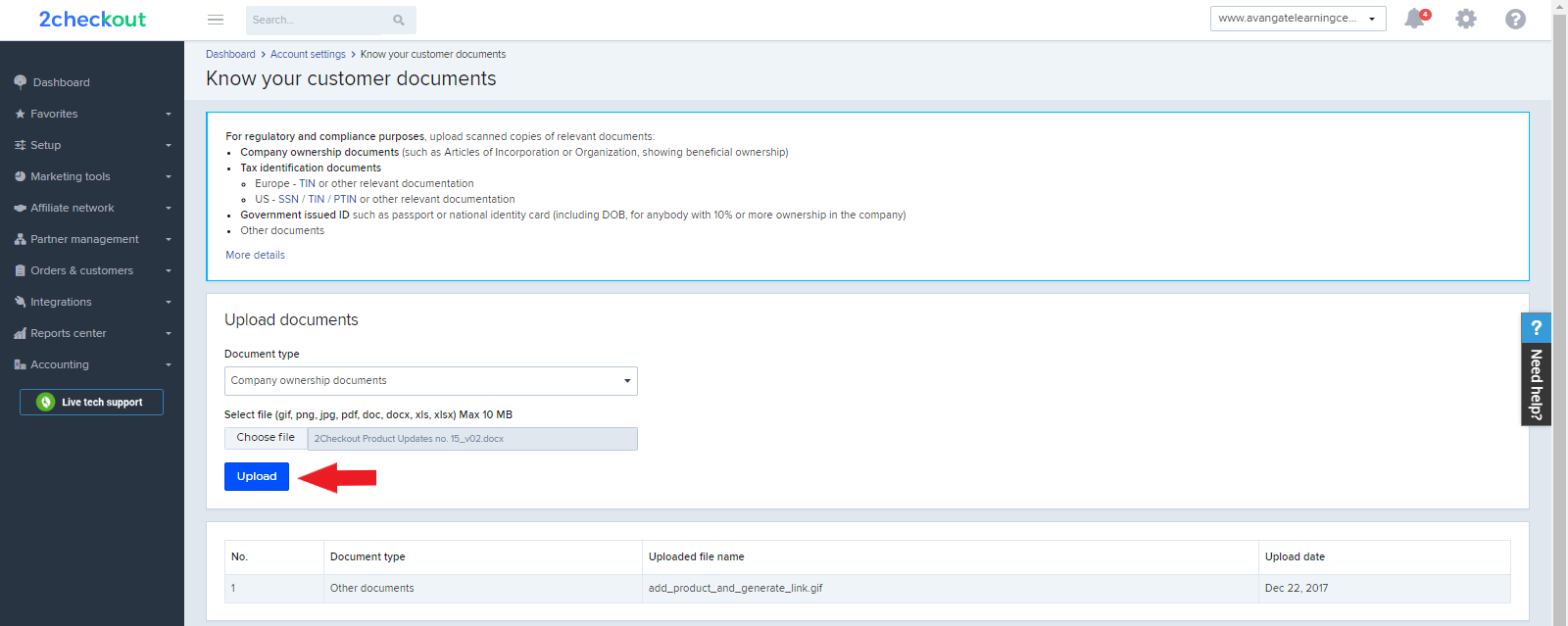

5. After adding your scanned copies of documents, click on the Upload button.

As regulatory and compliance obligations change over time, 2Checkout can request additional valid, relevant documents to verify your identity and proof of ownership of your company.

KYC Documents Checklist

The document checklist is different for individuals and for businesses/companies.

Individuals

- Valid government-issued ID such as a passport or national identity card

- Valid address proof, such as electricity bill, telephone bill (no older than two months from the date when you upload the scanned copies)

- Any other valid, relevant documents that can prove your identity (in addition to the government-issued ID)

Companies/Business Entities

- Company ownership documents (such as Articles of Incorporation or Organization, showing beneficial ownership)

- Tax identification documents

- Europe - TIN or other relevant documentation

- US - SSN / TIN / PTIN or other relevant documentation

- Valid government-issued ID such as a passport or national identity card. Include DOB, for anybody with 10% or more ownership in the company

- Any other valid, relevant documents that can prove your identity and offer proof of ownership for your company.