Relationships

When setting up the environment, an organisation can represent any type of organisation in a hierarchy - from a payment service provider, to an acquirer, to a merchant, and their respective subsidiaries. Such as having a European HQ, with sub-organisations representing operations in France, the UK and Belgium. Organisations allow for an unlimited hierarchy, starting at the headquarters level and going down as far as a single department of a sub-organisation, or even further, depending on the level of distinction you’re aiming for processing online transactions.

Processor entities are available to a given organisation to process for a particular payment method - it creates the link between the acquirer or other payment method processor to the organisation. Merchant credentials assigned by the relevant processor will need to be entered in the Processor entity. Processors can be reused for different accounts in case the Merchant account of the acquirer / processor supports multi-currency.

Accounts (not to be confused with user accounts) represent the different cashflows you wish to receive. You can set accounts depending on region, or the type of payments you want to receive (direct or subscription billing). A single organisation can use multiple accounts to distinguish incoming payments. A single account is limited to a currency, and to a collection of processors. In practice, this means a single account can process one currency and process using multiple processors as long as those are unique; unique meaning, one account can use one processor of the same payment method (e.g., cards, PayPal)

To process payments, an organisation must have processors and accounts. Processors are available within the scope of an organisation. For an account to receive payments for 1 or more processors, they must be linked.

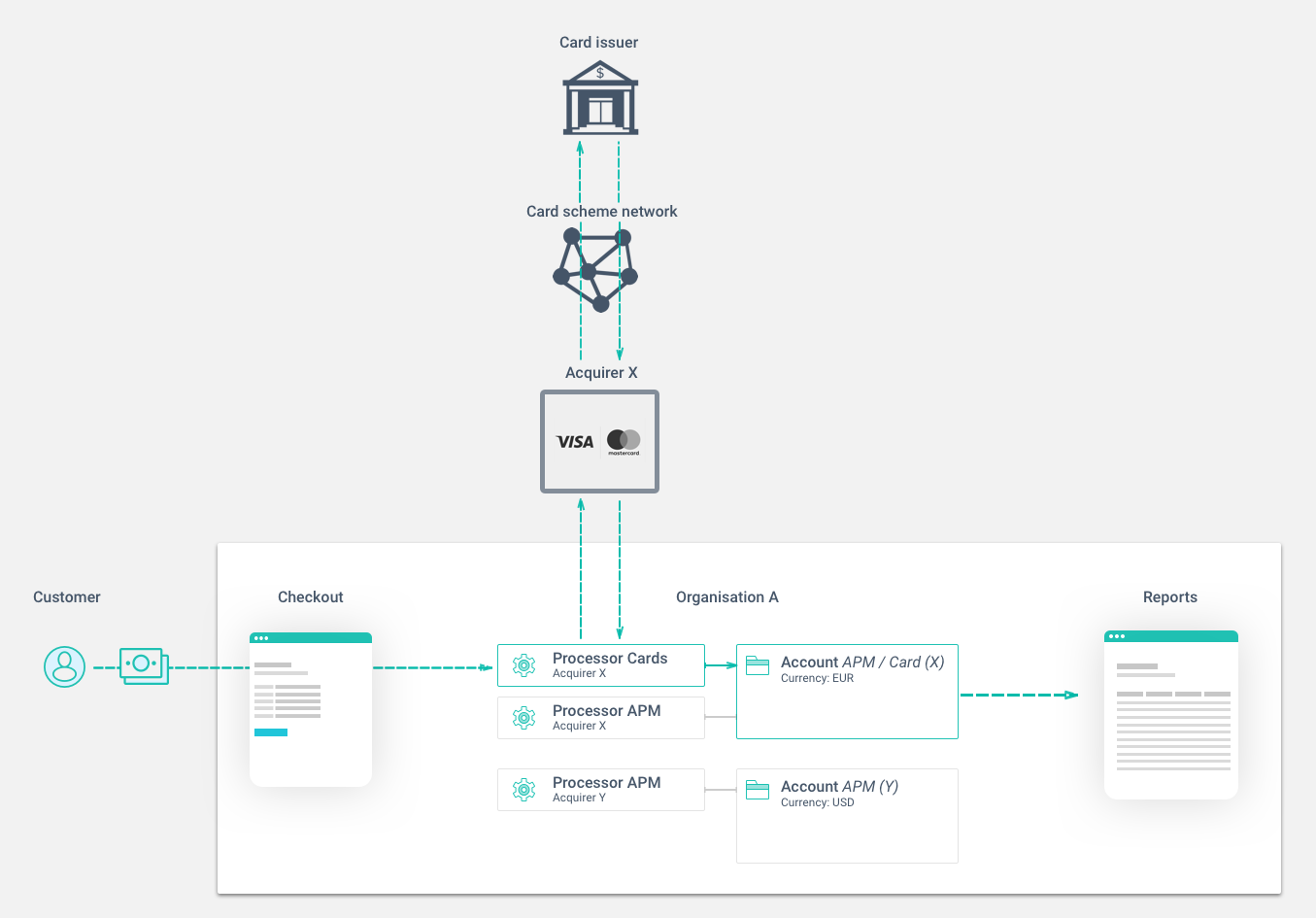

The diagram below shows the way a transaction then flows from customer to your transactions report in our UI (using a card transaction as an example):

Important terminology in this diagram:

- Checkout - The payment form hosted within our secure domain that the customer uses to initiate the payment.

- Acquirer - An external financial institution that offers merchants a way of receiving payments for a given payment method.

- Card scheme network - A network that processes card transactions based on the guidelines of for example Mastercard and Visa.

- Card issuer - The bank that issued the customer their card.

- The customer reaches the checkout page hosted in our secure domain, and proceeds with the payment

- The transaction's details are matched with the credentials in the processor, to determine for which merchant and with which acquirer the transaction will be processed

- The data is past on all the way to the card issuer, which will either approve or decline the transaction based on the account associated with the card holder (a reason for a decline can be insufficient funds)

- Once approved, the transaction is stored in the account of Organisation A

- The transaction can be retrieved directly from the API or in the reports within the UI

Organisations

The organisation is the leading entity that users and accounts are placed in. Furthermore, processors and authenticators need to be created within an organisation. Read more about organisations here.

Accounts

Accounts belong to organisations and can have one or multiple processors and authenticators connected to it. It is not possible to connect multiple processors of the same payment method to a single account. Read more about accounts here.

Processors and authenticators

Processors and authenticators belong to both organisations and accounts. These entities are used to set up connections with the relevant payment methods, acquirers, POS transaction systems or other external services. The organisation level determines what accounts the entities can be connected to, all entities allways need to be connected to accounts in order to work.

Read more about: