Upsell

Overview

Upselling is the practice that allows you to invite your customers to purchase a higher-end product, an upgrade, or an additional item in order to make a more profitable sale. The 2Checkout Public API supports upsell campaigns through which you can recommend catalog products to your shoppers.

UpSell Object

Use the UpSell object in order to recommend products to customers via the JSON-RPC API 6.0.

Parameters

| Parameter name | Type | Description |

|---|---|---|

|

Name |

String |

Name of the upsell campaign. |

|

StartDate |

String |

The date when the up-sell campaign starts, in the YYYY-MM-DD format. Can be NULL (starts immediately after enabling). |

|

EndDate |

String |

The date when the up-sell campaign ends, in the YYYY-MM-DD format. Can be NULL (ends immediately after disabling). |

|

DisplayForManualRenewals |

Boolean/Integer |

Flag to control if the campaign will be displayed for manual subscription renewal orders. Can be set as true/false/0/1. |

|

Discount |

Object |

Discount definition object, details below: |

|

Type |

String |

Type of discount. Can be FIXED or PERCENT. |

|

Value |

Integer |

Percentage discount value (PERCENT discount only). |

|

Values |

Array of objects |

List of currency discounts (FIXED discount only), details below. |

|

Currency |

String |

Code of the currency for the related amount. |

|

Amount |

Integer |

Discount amount value for the related currency. |

|

DefaultCurrency |

String |

Code of default currency (FIXED discount only). |

|

PrimaryProduct |

Object |

Main (primary) product object, details below: |

|

Code |

String |

The code of the product that the recommendation is made for |

|

Quantity |

Integer |

The quantity for the primary product. Can be 0 (standing for any quantity) |

|

PriceOptions |

Array of objects |

Price options list for the primary product, details below: |

|

Code |

String |

Price option group code. |

|

Options |

Array of objects |

Price options list, details below: |

|

Code |

String |

Price option code. |

|

Value |

Integer |

Price option value (for scale interval price option group only). |

|

RecommendedProduct |

Object |

Recommended product object, details below: |

|

Code |

String |

The code of the recommended product. |

|

Quantity |

Integer |

The quantity for the recommended product. Can be 0 (standing for “match quantity” setting). |

|

PriceOptions |

Array of objects |

Price options list for the recommended product, details below: |

|

Code |

String |

Price option group code. |

|

Options |

Array of objects |

Price options list, details below: |

|

Code |

String |

Price option code. |

|

Value |

Integer |

Price option value (for scale interval price option group only). |

|

Enabled |

Boolean/Integer |

Sets the campaign enabled or disabled. Can be set as true/false/0/1. |

|

Description |

Array of objects |

List of campaign language descriptions, details below: |

|

Language |

String |

The language code. |

|

Text |

String |

The text of the description in the associated language. |

| UpsellingDisplayType | String | Set upsell settings display type. Can be overlay, interstitial. |

Integrate Drupal Commerce

Overview

Integrate Drupal Commerce to be able to process payments through the 2Checkout platform in over 200 countries and more than 100 currencies.

Drupal Commerce is revolutionary software integrating commerce, content, and community to create engaging Web experiences that bring e-retailers more traffic to drive more results. With Drupal Commerce, online retailers have a simple yet powerful platform and the flexibility to integrate a rich commerce experience anywhere within their environment.

Availability

Before you are able to start accepting payments, you need to request and finalize the activation of your live account by completing a form, and provide information that will help us verify the business and identity of the individuals involved in your business.

Drupal Commerce integration is available only for 2Checkout accounts that handle their own tax and invoice management (2Sell and 2Subscribe).

Drupal Commerce Settings

Perform the below set of instructions in your Drupal Commerce account to integrate it with 2Checkout.

- Download the new 2Checkout module from Github.

- Upload the files to your server under your store’s directory.

- Log in to your Drupal Commerce admin area.

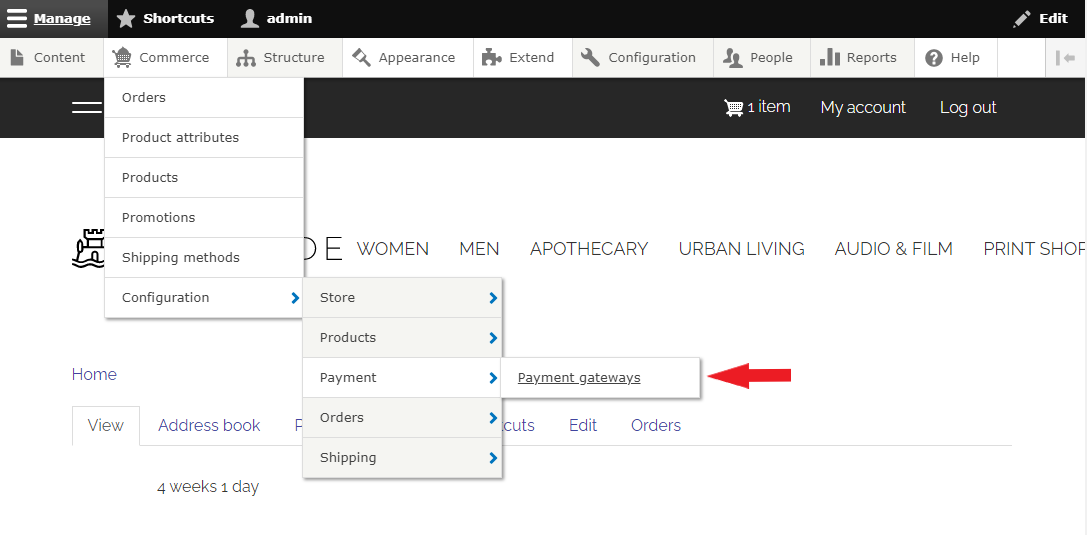

- Navigate to Commerce → Configuration → Payment and click on Payment gateways.

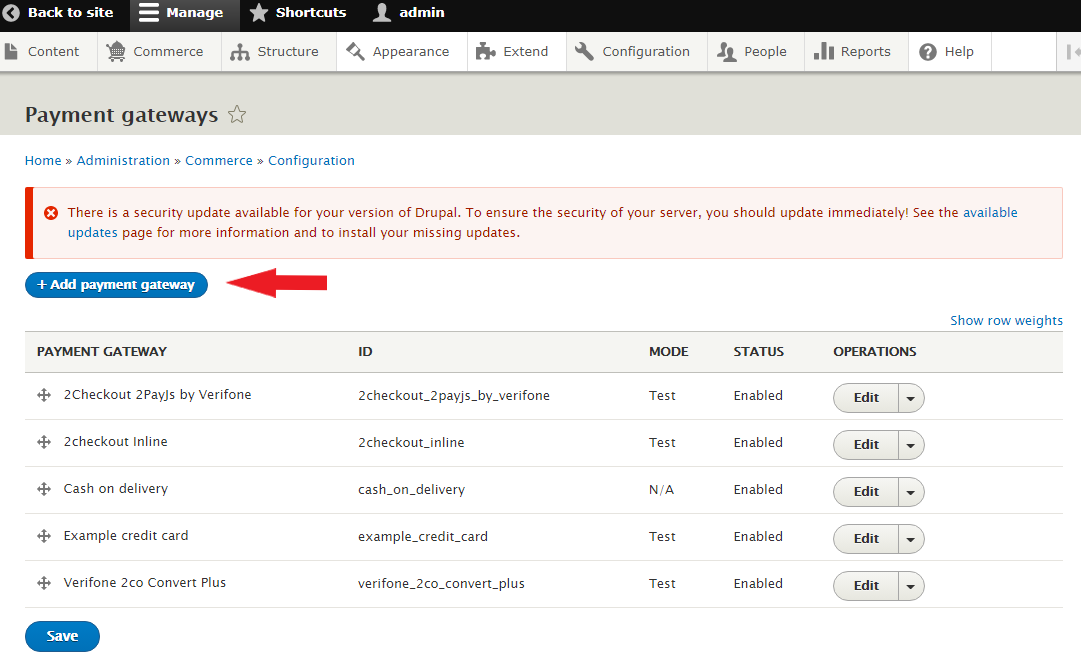

5. On the Payment gateways page, click on Add payment gateway.

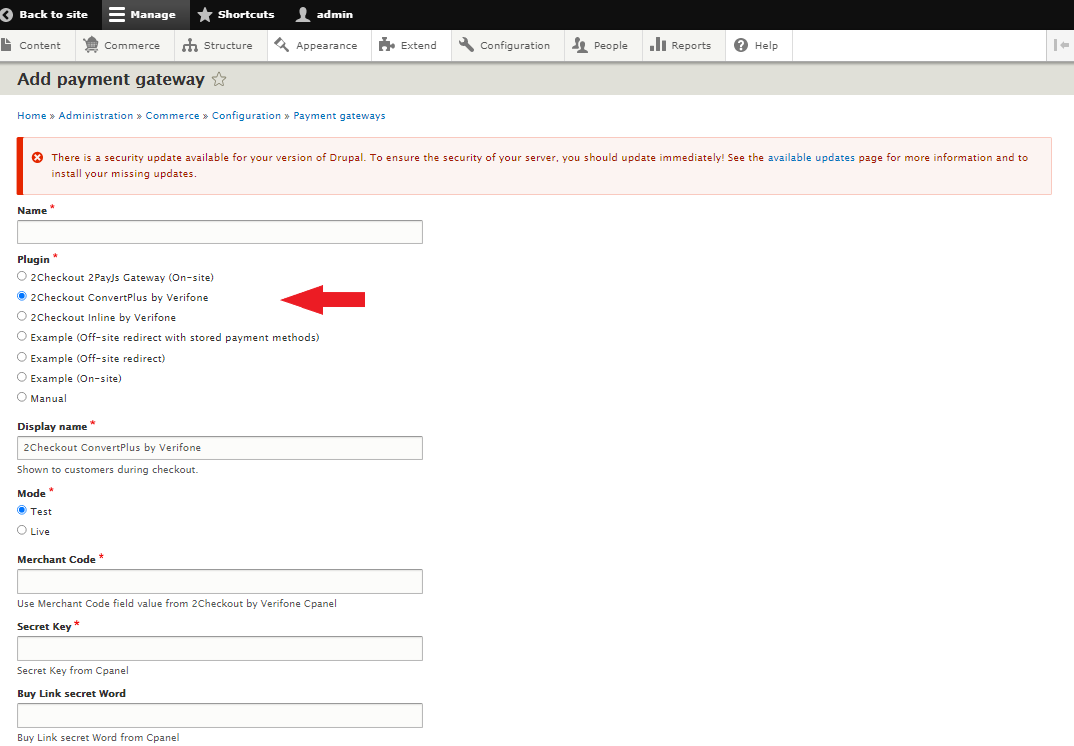

6. On the Add payment gateway page, select 2Checkout ConvertPlus by Verifone/2Checkout InLine by Verifone/2Checkout 2Pay.js.

7. Fill in the rest of the fields on the page:

- Display name

- Mode (select Test to be able to place test orders)

- Merchant Code - This is the 2Checkout Merchant Code, and you can find it in the 2Checkout Merchant Control Panel, under Integration → Webhooks and API.

- Secret Key - (you can find it in the 2Checkout Merchant Control Panel, under Integration → Webhooks and API)

- Buy-Link secret Word (you can find it in the 2Checkout Merchant Control Panel, under Integration → Webhooks and API)

- Conditions

8. Select Enabled to activate the plugin.

9. Click Save.

About Drupal Commerce

Drupal Commerce is revolutionary software integrating commerce, content, and community to create engaging Web experiences that bring e-retailers more traffic to drive more results. With Drupal Commerce, online retailers have a simple yet powerful platform and the flexibility to integrate a rich commerce experience anywhere within their environment.

Drupal Commerce provides the structure you need to do eCommerce without any assumptions about how your business is done.

Monthly recurring revenue

Comparative report showing the evolution of the total revenue and monthly recurring revenue over the past 12 months. Includes data for finished and refunded orders. The report also shows the percentage of renewal orders out of the total revenue. During currency conversion, the report uses the average exchange rate calculated for each month.

Monthly Recurring Revenue (MRR) is an excellent tool to understand how much of the total revenue per month is made up from renewals (customers that extended their subscriptions).

- Selecting a billing currency centralizes data for finished and refunded orders paid in the specified currency.

- Selecting the default payout currency centralizes data for all finished and refunded orders settled in the default payout currency, excluding the ones settled in any of the other settlement currencies.

- Selecting a non-default payout currency centralizes data for all finished and refunded orders settled in the selected currency.

Leads

Overview

2Checkout's lead management is a smart and easy way to reduce customer churn and gain useful insights into what drives customers to cancel automatic renewals. Use the Lead object to configure lead management campaigns via JSON-RPC API 6.0 to reduce unfinished payments and cart abandonment.

You can use lead management to:

- run a report on unfinished payments

- send abandoned shopping cart follow-up emails

- request invoices

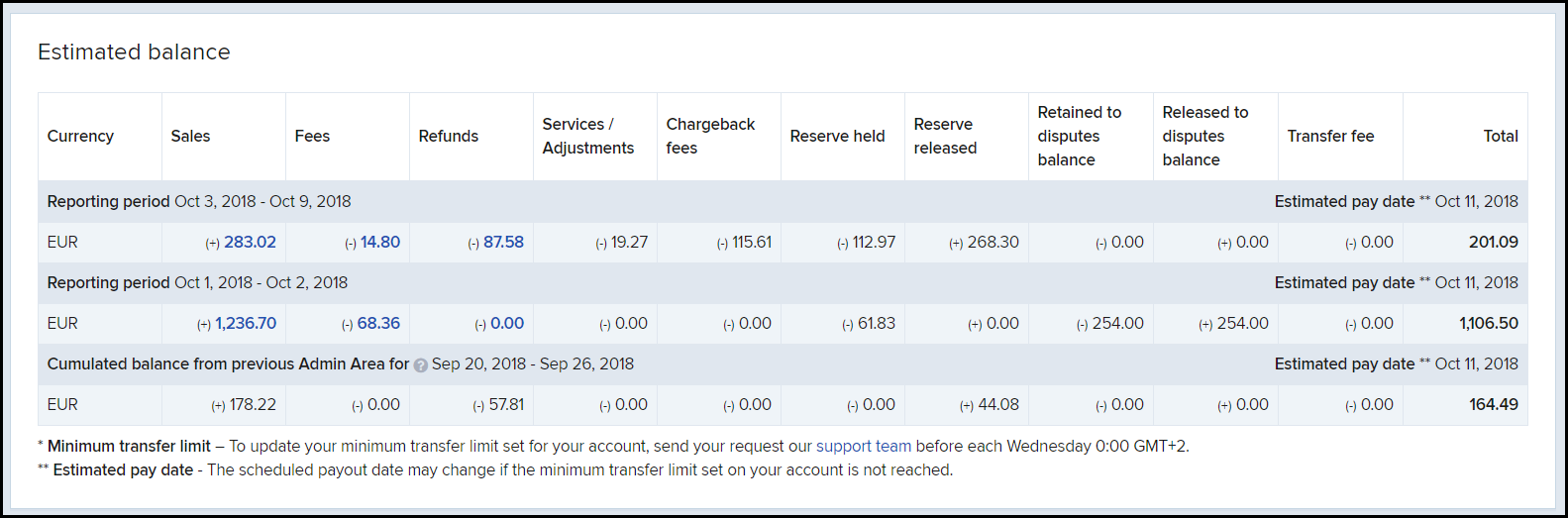

Estimated current balance

Overview

You can use the estimated current balance table to check the approximate account balance and find information on your estimated next payment.

Once logged into your Control Panel, you can access the report from Accounting → Estimated balance.

The amounts expressed in this report are estimated and may change as a result of new account activity.

Account information

On the Estimated current balance page, you can see the most important financial metrics from your account. You can view the amount that will be remitted to you at the next payout, the total balance amount that 2Checkout owes you, and the minimum transfer limit set on your account.

Estimated next payment

Use the Estimated next payment card to view the amount that will be remitted to you at the next payout by 2Checkout. The Estimated next payment amount is expressed in the payout currency available on your account.

Deposit balance

Use the Deposit balance card to view the total amount 2Checkout owes you for the deposits retained on your account. Your account deposit balance is computed by adding up the deposit amounts withheld in the past 90 days. Deposits are released back to you in the next payment cycle occurring 90 days from the date when the deposit was initially withheld.

The deposit balance amount is displayed in the payout available on your account.

Minimum transfer limit

Use the Minimum transfer limit card to view the amount you need to reach to receive payouts from 2Checkout.

To update/change your minimum transfer limit set for your account, click on the Change button or go to your Settings area to submit your request to our Financial Operations team.

Report information

The estimated current balance report returns account balance information for each of your payout currencies. In case you have updated your payout currency, data from the table is displayed using your new payout currency.

The time zone used for displaying the data is GMT+2. Your current account balance is split based on:

- Reporting period - Sales, fees, refunds, and any activity with financial impact are displayed within the reporting period when it incurred. For each reporting period row, 2Checkout displays the estimated payout date (when your payout will be remitted). Note that the estimated payout date might change if your transfer limit is not reached.

- Amount source - Your account balance is displayed based on the amount source type (sales, fees, refunds, chargeback fees, reserves retained, reserves released, or transfer type).

Sales

Sales deposited included into payout balance. Click on the Sales amounts to be redirected to the Order search and view the data underlying the amounts displayed in the Estimated current balance page.

To extract detailed information on your sales, follow these steps:

- Log into your Control Panel.

- Navigate to Orders & customers → Order search.

- Run a report for your completed sales (status Finished) for the period reported in the estimated current balance.

- Export the information and check the total sales amount.

Fees

To see the processing fees charged by 2Checkout for the sales included in the balance, click on the Fees amounts to be redirected to the Order search and view orders for which 2Checkout applied processing fees.

To retrieve additional information on your fees, follow these steps:

- Log into your Control Panel.

- Navigate to Orders & customers → Order search.

- Run a report for your completed sales for the period reported in the estimated current balance.

- Export the information and check the processing fee amounts in your payout currency.

Refunds

This amount represents the orders refunded in the reported period. Click on the Refunds amounts to be redirected to the Order search and view orders for which 2Checkout applied processing fees.

To retrieve additional information on your refunds, follow these steps:

- Log into your Control Panel.

- Navigate to Orders & customers → Order search.

- Run a report for your processed refunds (status Refunded) for the period reported in the estimated current balance.

- Export the information and check the refund amounts in your payout currency.

Services/Adjustments

Various adjustments refer to the collection of a negative balance, the return of fees on a canceled sale, or any other special requests.

Contact 2Checkout's Financial department for additional information regarding the amounts retained as adjustments.

Chargeback Fees

Chargeback fees are the fees applied by 2Checkout for chargebacks opened in the reported period.

To retrieve additional information on your chargeback fee, follow these steps:

- Log into your Control Panel.

- Navigate to Reports Center → Main reports.

- Expand the Financial reports section and select Chargeback reports.

- Run a report for your disputes opened in 2Checkout for the previous reporting period.

- Check your total dispute rate used for calculating the chargeback fee.

Retained to disputes balance

This is the amount retained for orders with chargeback requests initiated.

To retrieve additional information regarding the dispute balance retained amounts, follow these steps:

- Log into your Control Panel.

- Navigate to Reports Center → Main reports.

- Expand the Financial reports section.

- Go to the Monthly revenue split report and click on Set up report.

- On the Revenue split page, select the period for which you want to run the report.

- Select the Disputes balance checkbox.

- Click on the Build report button.

- On the next page you'll be able to see both the Retained to disputes balance as well as the Released from disputes balance.

Released to disputes balance

This is the amount released for orders with closed chargeback requests. To retrieve additional information regarding the dispute balance released amounts, follow the same steps as those for the retained to disputes balance.

Transfer fee

Transfer fees are amounts charged by 2Checkout for the payment transfer. Transfer fees are charged only for the payout method International Wire.

Contact 2Checkout's Financial department for additional information regarding the transfer fees charged for your payouts.

Additional checkout fields

Overview

Define additional checkout fields to be displayed in the shopping cart, helping you collect extra information from your shoppers. You can configure custom fields to be displayed at both product and order levels.

Availability

This functionality is available for all 2Checkout accounts.

How do I receive additional checkout fields?

Customer-specific information collected via custom additional fields is sent in several ways:

- in the "Order notification email" - sent by the 2Checkout system, information filled by your customers will be sent along with all the order information in the Additional Information section.

- in the "IPN (Instant Payment Notification)" - if this service is enabled, the additional fields are included in the HTTP POST sent by the 2Checkout system.

Additional checkout fields are not included by default in the IPN HTTP POST. To include these fields, as well as other additional order information you have to check CUSTOM_FIELDS[] on the IPN Settings page.

The following IPN variables are available:

additional checkout fields

| Field | Description | |

|---|---|---|

| IPN_CUSTOM_TEXT[] | Array with all the custom fields texts set per order. | |

| IPN_CUSTOM_VALUE[] | Array with all client input corresponding to the text. | |

|

Example |

||

| IPN_CUSTOM_TEXT[] | 0 | Where did you first hear about us? |

| 1 | Would you like to receive regular updates? | |

| IPN_CUSTOM_VALUE[] | 0 | From a friend |

| 1 | CHECKED | |

Product additional checkout fields (dynamic fields):

Product name: 123456

Product ID in the 2Checkout system: 123456

| Field | Description | |

|---|---|---|

| IPN_CUSTOM_123456_TEXT[] | array with all the custom fields texts set per product. | |

| IPN_CUSTOM_123456_VALUE[] | array with all client input corresponding for the text. | |

| Example | ||

| IPN_CUSTOM_123456_TEXT[] | 0 | Product code |

| IPN_CUSTOM_123456_VALUE[] | 0 | 123456 |

Additional information can be found in the Merchant Control Panel in these sections:

Create custom fields

- Go to Setup → Ordering options.

- Click Manage additional order fields.

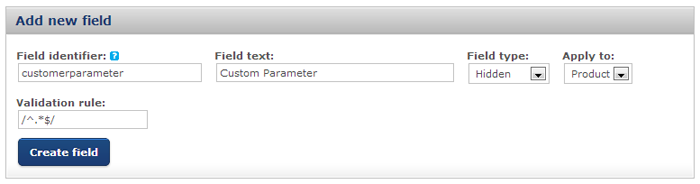

- Use the Add new field section to define each new field. Enter the Field identifier. Use unique identifiers for all your fields. Note: This field accepts only alpha-numeric characters. If you leave this field empty, 2Checkout generates a random value as an identifier.

- Enter the Field text (the name of the field).

- Set the Field type. There are four available types.

- Textbox allows shoppers to write what they want in the field. You can use it to collect feedback or opinions on the shopping experience, for instance.

- Checkbox allows shoppers to select various options. You can use it for a quick survey.

- Listbox displays a drop-down list your shoppers can select items from.

- Hidden helps you define custom URL parameters for tracking purposes. For details on this option, read our dedicated article.

- Use the Apply to drop-down to choose whether the field should apply at the product or order level.

- Use the Validation rule field to specify the regular expression to validate the field values. Note: Not supported on Inline Checkout. The field can be set, but it will be ignored during the checkout process.

- Click Create field to save the new field.

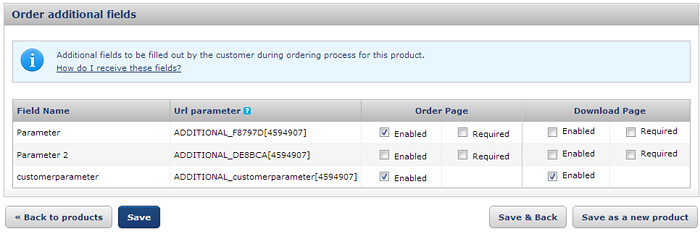

Set additional checkout fields for products

Requirement

Follow the steps in the Create custom fields section to create new fields and apply them at the Product level. Then, follow the steps below to assign the field to a product.

- Go to Setup → Products.

- Click Edit on the product you want to assign the field to.

- Go to the Information tab and scroll to the bottom of the screen. You'll find the previously defined additional fields in the Order additional fields section. All new fields are disabled by default.

- Check the Enabled option on the Order page column corresponding to the field you want to use. Check the Required checkbox if you want the field to be mandatory during the checkout process.

- Click Save.

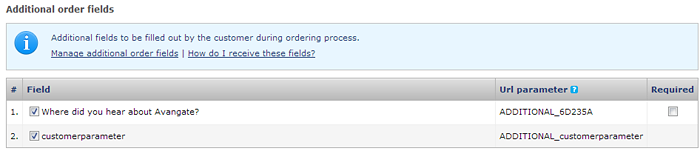

Set additional checkout fields for orders

Requirement

Follow the steps in the Additional fields settings page in your Merchant Control Panel to create new fields and apply them at the Order level. Then, follow the steps below to assign the field to order.

- Go to Setup → Ordering options.

- Scroll down to the Additional order fields section and got to the Click here to create and manage link.

- To create a new additional field, follow these steps:

- Go to the Add new field section

- Fill in all the fields displayed

- Click Create field to save the new field.

- To edit an existing additional field, you need to:

- Go to Dashboard → Setup → Ordering options → Additional fields settings

- Scroll below the Additional fields settings section

- Choose the field you want to modify and update its fields.

- Scroll to the bottom of the page and click Update fields to save your new settings.

- To delete an additional field, leave the field empty and click on the Update fields button. Those fields assigned to products will be deleted as well.

- To activate an existing additional field, see the steps below:

- Go to Dashboard → Setup → Ordering options → General

- Scroll down below the Additional order fields section.

- In the list of additional fields, check the checkbox next to the field you want to use.

- Check the Required checkbox if you want the field to be mandatory during the checkout process.

- Click Save Settings at the bottom of the page.

Additional field types

- Textbox - a text field that allows the customer to enter text information about the additional field.

- Checkbox - a small checkable box that allows the customer to enable or disable an element. It can be checked or left empty.

- Listbox - it displays a scroll-down list of elements that allow the customer to select one or more items from the list contained within the static text box.

- Hidden - it cannot be seen or modified by customers.

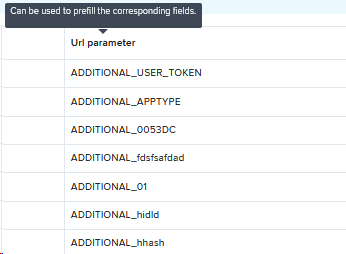

Pre-fill additional information fields

You can pre-fill the additional information fields by passing the &ADDITIONAL parameter in the URL.

The parameter would look like this: &ADDITIONAL_(insert additional field identifier here)[product id]=(insert value here).

For example, if you want to pre-fill the additional information field with 'test.com', your checkout buy-link would look like this:

&ADDITIONAL_92E8A6[4674306]=test.com

Where ADDITIONAL_92E8A6 is the URL parameter as shown in your Merchant Control Panel.

Partner refunds

Overview

The Accounting area of the Partner Control Panel centralizes order payment data and enables partners to manage their invoices and refunds. Both you (merchant) and your partner can request refunds for paid partner invoices logged by the system. In case you request a refund, your partner will get an automatic notification of the approved reimbursement, along with the costs of the transaction.

Availability

Partners can request refunds for a period of up to one (1) year from the moment when an order was paid and the product delivered. Refunding a payment is only possible for up to one (1) year after the order was finished/delivered, older orders being considered final, reimbursements are no longer available.

Refunds management

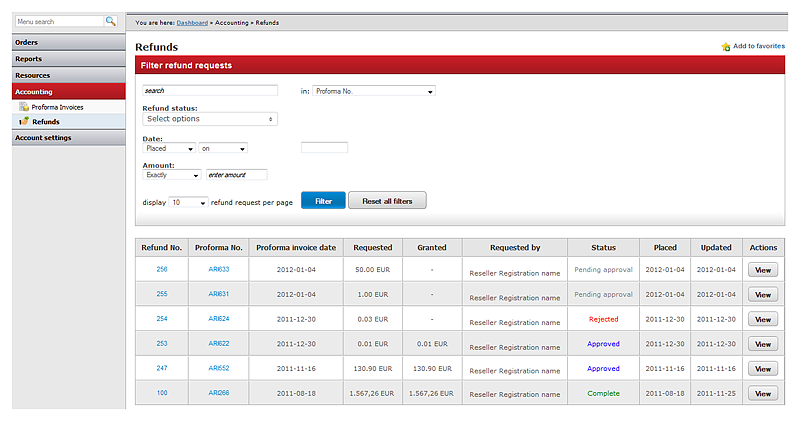

The Partner Control Panel offers your partners refund management capabilities, including searching for reimbursements and viewing details. Under Accounting → Refunds, your partners can search for refunds based on partner number, refund number, or payment reference number, and setting a number of filters such as status, date of placement, and amount. This area displays all partner invoices for which a refund was requested. Partners can see the status of the refund, the amount granted during the refund operation. They can also access the details of a refund by clicking either on the refund number or on the View link and review the partner invoice info by selecting the partner number.

Refund new licenses

Partners can also request refunds on their own by accessing the paid partner invoice for which they want the costs of a transaction reimbursed.

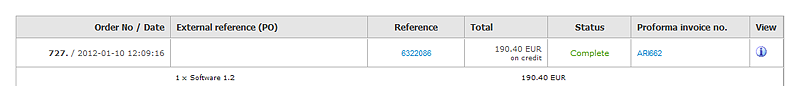

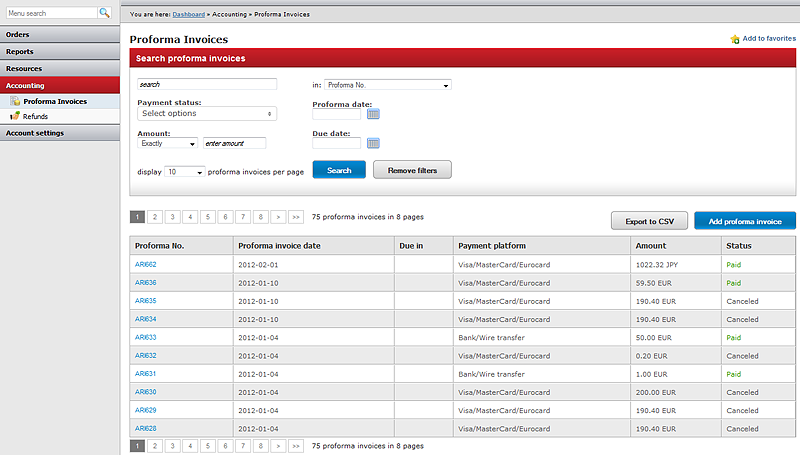

Partner invoices are available either under Orders → All orders for a specific order or through Accounting → Partner Invoices. The latter path is recommended, since the partner invoice list also shows additional information including Status, a key piece of data, considering that only orders for which the payment was already transferred can be refunded.

In the Partner Invoices area, once the partner ran a search and identified the item for which they're requesting a refund, they can click on the partner number. In the area at the top of the screen under Partner status, they can select Request refund.

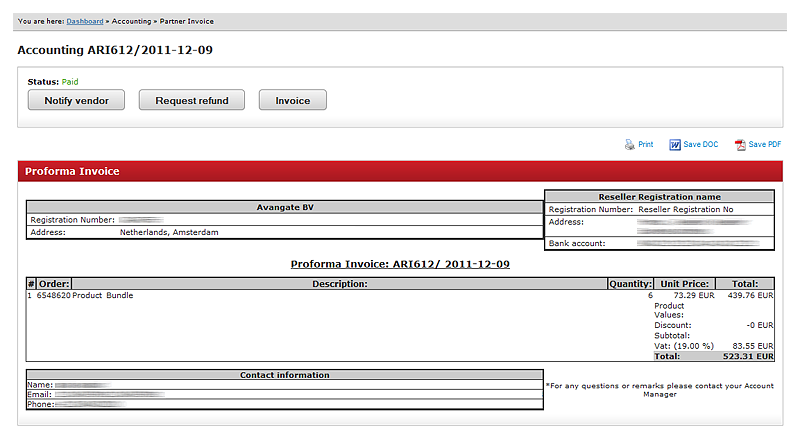

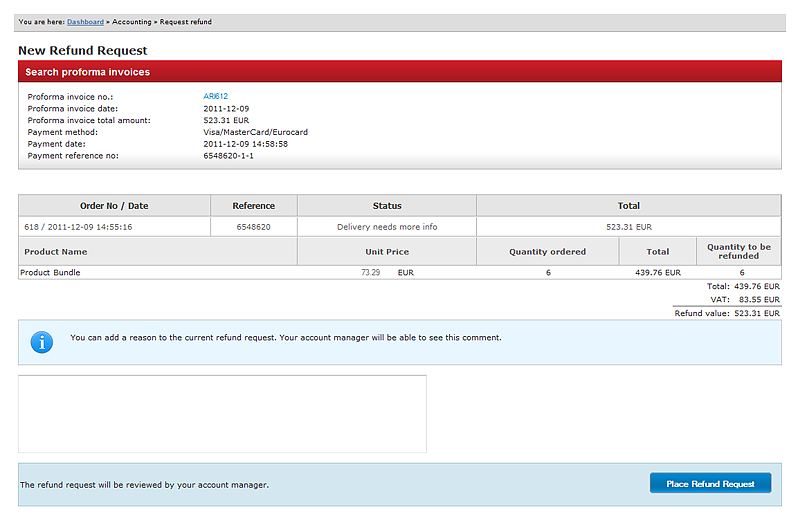

On the New Refund Request screen, partners can review the details of the original partner invoice and add comments. The request for a refund will be placed once the Place Refund Request button is clicked.

The status of the partner invoice will change from Paid to Pending approval. Following the automatic notification received from the system, you (merchant) can approve or reject the refund request. Refunds can be provided for the full costs of the transaction, as well as only for a partial amount. In either situation, partners will receive an email notification with your resolution.

Once the request refund is generated, the partner invoice will also be featured under Accounting - Refunds. The status of a refund will be updated to Complete for reimbursements that were approved and repaid.

All payment/invoice reference information necessary for the refund to be processed is automatically "pulled" into the refund module. A Credit Note for the approved refunded amount will be associated with the invoice that the refund was requested for. Each credit note has a corresponding negative payment record.

If the payment was done via 2Checkout eCommerce platform, by any payment methods available, the refunded amount will come from 2Checkout. If the payment was collected directly by you (merchant), via any payment method, then you are the one providing the refund.

Refund renewals

In addition to the transaction costs of new licenses, partners can also be reimbursed for renewals.

For this, partners can navigate to Accounting - Partner Invoice and search for the partner invoice of the renewal order that they want to be refunded. As long as the partner invoice was already paid, with the payment also reflected by its status, they can click on the partner number and then follow the same steps as when asking for a refund for a non-subscription license. As a result of the refunding process, all future renewal licenses will be canceled.

FAQs

-

Does 2Checkout send notifications for refunds?

Yes. Both the merchant and the partner will receive notification emails with information on the evolution of the refund, regardless of whether it was approved or rejected, and also have the option of viewing the details of orders for which a refund was issued.

-

How is the refund reflected in the order status?

After Total or Partial refunds are approved and the transaction sums reimbursed, the status of the orders changes to Complete.

-

How much time does it take for a transaction to be refunded?

Once a refund was approved, reimbursement occurs in up to eight (8) business hours, if the initial payment was done through Visa/MasterCard/Eurocard, American Express. The refund amount will be available in the partner's bank account after the refund is processed, depending on the issuing bank.

In scenarios in which the transaction was done through direct Bank/Wire transfer, 2Checkout will refund the money in several days after the partner provides all necessary financial details.

Note: The merchant is solely responsible for reimbursing the payments the partner made through direct Bank/Wire transfer.

-

Can more than one refund be provided for the same order?

No. Only a single refund can be issued per order. Once the transaction for an order has been refunded, either in part or the full amount, no additional refunds can be requested or provided. Note: Since the details of a refund are final, these should be correct before requesting reimbursement.

-

Can refunds be requested directly from 2Checkout?

Yes. 2Checkout evaluates refund requests from both merchants and their partners. In case the partner contacts 2Checkout directly, the merchant will be notified via email and needs to reply as soon as possible.

-

Are there any costs associated with a refund?

In case the refund is done through wire/bank transfer, the partner will need to cover the costs of the transaction - 2Checkout does not charge anything when refunding payments. Note: The order processing commissions paid by the merchant and received by 2Checkout will not be returned.

-

Can keycodes for a refunded product be reused?

Keycodes for electronic delivery can be re-used, but only if they are part of static lists or if the lists allow the use of duplicates. Keycodes from static lists can be assigned to multiple instances of a product or to multiple products.

-

What happens to refunded subscriptions?

The transaction amount considered for reimbursement for subscriptions can be just the last payment or all payments made, with forthcoming renewal licenses being canceled automatically.

-

What types of orders can be refunded?

Total and Partial refunds may be performed only against settled transactions for which a partner invoice was already issued and paid associated with orders with a Complete status. Orders with one of the following status labels cannot be refunded: Pending approval, Refunded, Canceled, Payment under review, Rejected, Awaiting Payment, and Delivery needs more info.

Product Tax Category

Overview

2Checkout added a new product attribute in the Merchant Control Panel, the Product Tax Category, to increase the accuracy of the tax determination and reporting process.

Availability

Available by default for all 2Checkout merchants. Read here how to apply the Product Tax category from your Merchant Control Panel.

Product Tax Category rules

| Product Tax Category | Category Description | Business Model Availability |

|---|---|---|

| Credit reports | Credit scores and other credit characteristics of individual consumers (the US only). | Merchant of Record |

| Electronically-delivered software | Software that is primarily downloaded from the Internet and operates from customers' computers. | Merchant of Record/Payment Service Provider |

| Digital products | Examples are digital books and newsletters, digital music or other audio, digital audio-visual works, pictures, online games, ringtones, etc. | Merchant of Record/Payment Service Provider |

| Digital Products - Educational/Training Content | Items of audio or visual work that is delivered electronically and used for educational or training purposes. This includes but not limited to educational videos, music, photos, pre-recorded courses, exams. | Merchant of Record/Payment Service Provider |

| Software as a Service (SaaS) | Online software-based services where primary functions are performed on remote servers. Software primarily resides in cloud or remote servers, not on the customer computer. Examples are Virtual Private Networks (VPN), data storage or backup online, website optimization, etc. | Merchant of Record/Payment Service Provider |

| Technical support/Helpdesk services | Online or telephone support services for software or hardware. | Merchant of Record/Payment Service Provider |

| Specialized education services | Online training or learning modules. Excludes in-person training. | Merchant of Record |

| Seminars-Online | Online training or learning modules. Excludes in-person training. | Merchant of Record |

| Physical Goods | Generic Taxable Product | Payment Service Provider |

| Supply of Services | Payment Service Provider |

Taxes differ according to the various product tax categories. Tax deduction takes into account the product tax category added at product level for more accurate tax determination (for example, there are certain states in USA where SaaS products are charged an 8% sales tax, others where the sales tax is 0%).

Default Tax category assignment

- For the 2Monetize accounts: Products that don't have a tax category assigned will be automatically considered as "Electronically-delivered software".

- For 2Sell & 2Subscribe accounts: Products that don't have a tax category assigned will be automatically considered as “Physical Goods”.

For all new products, the selection of the Product Tax category is mandatory.