PayPal Disputes

Last updated: 13-Mar-2024

Overview

Occasionally, something goes wrong with a customer's order. To dispute a charge, a customer can create a dispute with PayPal or ask the card issuer to dispute and reverse a charge, which is known as a chargeback.

There are three ways that a buyer can initiate a complaint. And that process, including time frames and who oversees settling the dispute, will vary depending on how the purchase was funded:

- Dispute/claim: Buyer enters their dispute directly through PayPal’s Resolution Center site to file a dispute; however the two parties should work together to find a solution. If the buyer and the seller cannot agree to a solution, the buyer can escalate the dispute to a claim to request a refund/reversal where PayPal steps in to determine how the situation should be resolved.

- Chargeback: Buyer contacts their card issuer and requests a refund.

- Bank reversal: Buyer contacts their bank to request a refund.

Claims and disputes life cycle

- Buyers files disputes/claims directly through PayPal (Resolution Center or phone call)

- Dispute phase: The buyer and the seller can come to a resolution without PayPal's involvement. After a dispute is open, the buyer and the seller have 20 calendar days to communicate before the dispute automatically closes. If the problem cannot be resolved within the timeframe, the case can be escalated to a claim either by the buyer or the seller.

- Claim phase: If escalated prior to 20 days, the seller will have 10 days to respond to a buyer claim with their evidence. PayPal will attempt to resolve the case within 30 days or less.

- Claim appeals: Sellers/buyers have the right to appeal the claim decision if they disagree with the decision outcome. They can appeal in the Resolution Center up to 10 days from the case closure date.

Chargebacks life cycle

- Chargebacks occur when buyers ask their credit card issuer to reverse a transaction that has already been approved

- The seller has 10 days to respond to PayPal's initial email. This may be shortened if needed, based on PayPal Response Date.

- PayPal has between 14 and 30 days to work chargebacks. Their handling requirements are set by the processor, in addition to the regulation set by the card schemes.

- Credit Card Processors have 75 days to respond to a dispute

Bank reversals life cycle

- A bank reversal sometimes called an ACH return, is when PayPal receives a request to return funds for a transaction that was funded by a bank account. This request might come from the buyer or the bank itself. Usually, this request is filed because of suspected unauthorized use of a bank account.

- The following events may trigger a reversal:

- The buyer's bank account was used without their permission to purchase an item fraudulently

- The buyer does not recognize the transaction

- The item that was purchased did not arrive

- The buyer was charged twice for the same item

Note: Once a reversal has been filed, the response time frame is between 7 and 10 days, or even less.

Process flows

PayPal disputes/claims process flow

PayPal chargeback process flow

Process description

Step 1 – Chargeback initiation (claims and disputes included)

The shopper contacts their card issuer or PayPal and initiates the chargeback process. Chargebacks may be issued for several reasons, including but not limited to the following:

- The shopper has not received the purchased items

- The shopper is unsatisfied with a purchase and has not been able to resolve the problem with the vendor

- The shopper has been charged multiple times for the same order

- Product not as described or defective

- An unauthorized party has made a purchase with the shopper's credit card*

- The shopper has concerns about the validity of the purchase (he does not recognize the charge on the statement)

- The shopper claims that he has not agreed to renewal

*For QR code-based payments with PayPal or Venmo, consumers are unable to file a dispute based on an unauthorized party using their account or card.

Step 2 – Notification of the chargeback

- When a new case is filed by a shopper, an email notification is triggered and sent to the merchant to inform about the dispute and ask for supporting documents

- The email notification includes details about the disputed transaction and what documents to provide to increase the chances of winning the chargeback: PayPal dispute number, reason for the dispute, transaction ID (Verifone Internal Transaction & PayPal Transaction ID), amount, date & time of transaction etc.

Step 3 – Logging the chargeback in Verifone’s Common Portal

- Once a transaction is disputed, the order will be automatically marked as disputed in the system with the reason received from PayPal

- The settlement amount for the dispute transaction is being frozen during the investigation

- The merchant has the possibility to view/retrieve/sort the disputes details in the Common Portal

- Within 3-5 working days, the merchant should provide via email any information or documents available that can help win the dispute

Step 4 – Representment process

- After receiving the challenge documentation from the merchant, the Verifone chargeback team logs on to the PayPal Resolution Center to provide evidence or to take other action to fight the dispute on behalf of the merchant.

- Verifone chargeback team will correspond via e-mail with the merchant to add additional evidence and complete additional action via the PayPal Resolution Center.

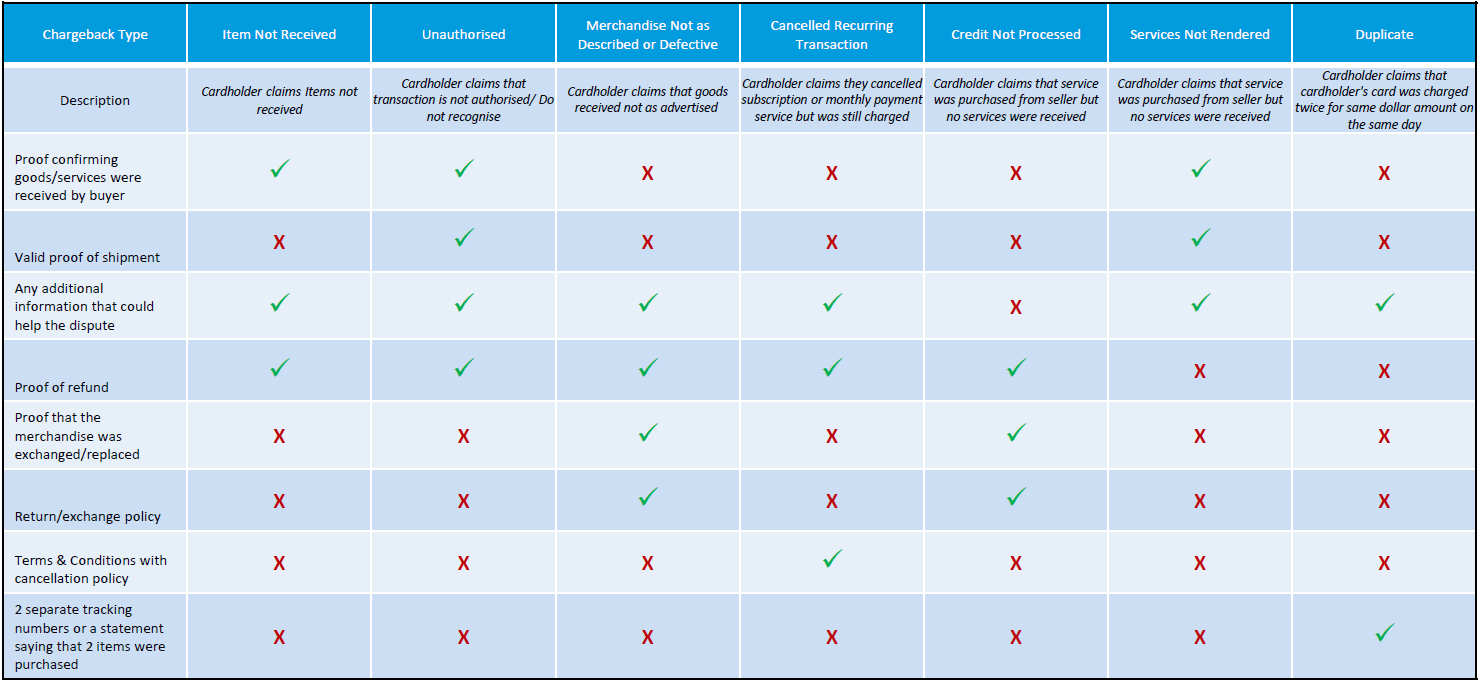

Compelling evidence required for representment

Unauthorized: For QR code-based payments with PayPal or Venmo, consumers are unable to file a dispute based on an unauthorized party using their account or card.

Step 5 – Closing the chargeback

- Based on the details provided by the merchant and uploaded by Verifone Chargeback Team in Resolution Center PayPal/the card issuer offers a resolution to the dispute.

- The decision is based on a standard set of rules and regulations created by PayPal/card schemes, and it is then communicated to Verifone and the shopper; the chargeback status will update automatically to won or lost.

- The merchant can log on to Common Portal to view dispute status

- If the chargeback is ruled in the merchant's favor, the funds will be released from hold

- If the chargeback is won by the buyer, the debit can be identified in PayPal settlement files

Rate this article: