MobilePay

Overview

MobilePay is a digital wallet for iOS and Android that can be used for person-to-person transfers, in-store purchases, subscriptions, invoices, eCommerce transactions, etc. MobilePay is the most popular alternative payment method in Denmark & Finland with over 6 million users and 60+ partner banks. The account is connected to the telephone number of the MobilePay user. Shoppers can use MobilePay in more than 220,000 Nordic shops and web stores.The application is protected by a user-selected four-digit PIN code or a fingerprint. The login ID is either the CPR-number (national ID number) or the more secure NemID.

This guide requires familiarity with Accepting payments.

Availability

To use MobilePay, merchants must have a national phone number/national-issued credit card/national bank account and a civil registration number.

MobilePay is available in Denmark, Finland, and Greenland in these currencies: DKK, EUR, SEK, NOK.

Access

To see the available permission levels for a specific merchant role check the Users and merchants roles documentation.

Benefits

- The conversion rate will increase as the number of transactions increases, as this is the preferred Danish and Finish payment method. Around 50% of all payments in Danish eCom are MobilePay transactions. In Finland, MobilePay is used in 25% of all eCom transactions.

- Increase your competitive advantage by using the shopper's preferred payment method.

- Simplify payment acceptance across different sales channels for Verifone Merchants.

- MobilePay wallet stores the shopper card information and offers shoppers an easy and fast checkout experience on the website, in-app, or in-store.

- Diversify your checkout payment methods and let the shoppers use their preferred ones.

- Shoppers can store multiple cards in one place, offering them easy accessibility to the accounts they want to pay with.

- Enable your shoppers to pay with their phones through contactless payment.

- Wallet tokenization provides one of the most secure payment methods available through 2-factor authentication, SMS, FaceID, and others.

Workflow

Verifone processes B2C payments with MobilePay via Nets (i.e., Verifone is not involved in the funds' flow) and provides Hosted Checkout, Pay By Link, Portal for Payment Actions (capture, cancel, refund), transactions reporting, 3DS report, and settlements reporting.

If you are already using Verifone's Hosted Checkout, once you have MobilePay activated as a payment method, this will be displayed in your shopping cart. When your shoppers choose to pay with MobilePay, they are redirected to the MobilePay payment flow to finalize their purchase. Then, Verifone returns the transaction response/confirmation to you.

By using MobilePay, you can initiate a payment via the checkout/HPP integration using Sales/Sales with delayed capture and pre-authorizations using Nets SDI PIM for processing, and you can perform the following payment modifications: delayed capture, refund, void (cancel the hold from a shopper account).

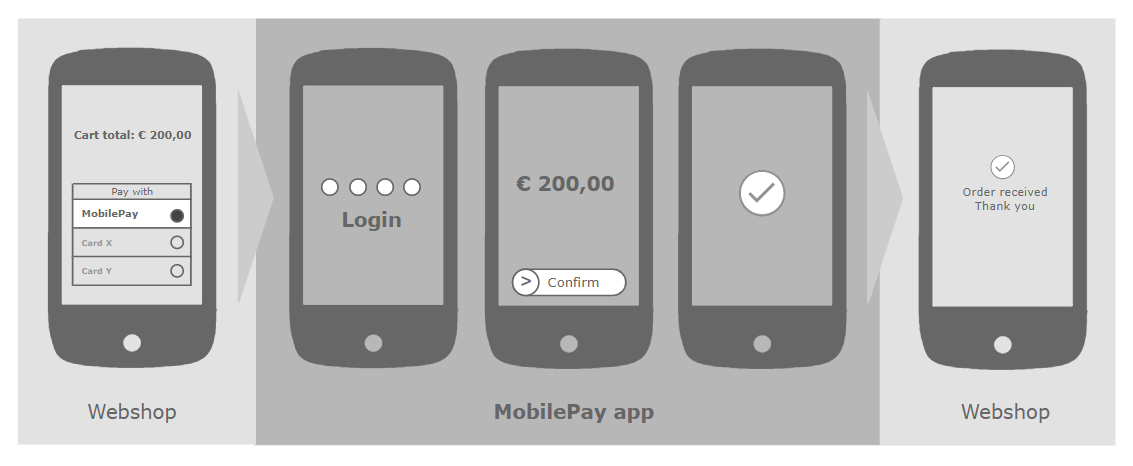

MobilePay Checkout (HPP) Flow

Before starting the checkout flow, the shopper needs to download the MobilePay app on their phone, though single device flow is also possible. Once the shopper adds an item to the cart and proceeds to the checkout by choosing to pay via MobilePay, they will be prompted with this flow:

- On the Checkout page (HPP), the shopper selects MobilePay as a payment method.

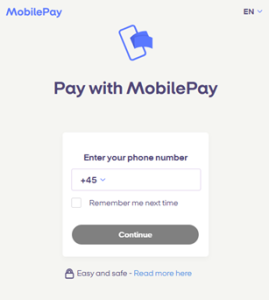

- After clicking the MobilePay button, the shopper is redirected to the MobilePay landing page where the customer needs to enter their phone number. The shopper has 5 minutes to press the Continue button and to add the phone number until the page expires.

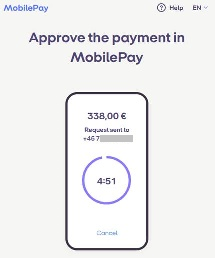

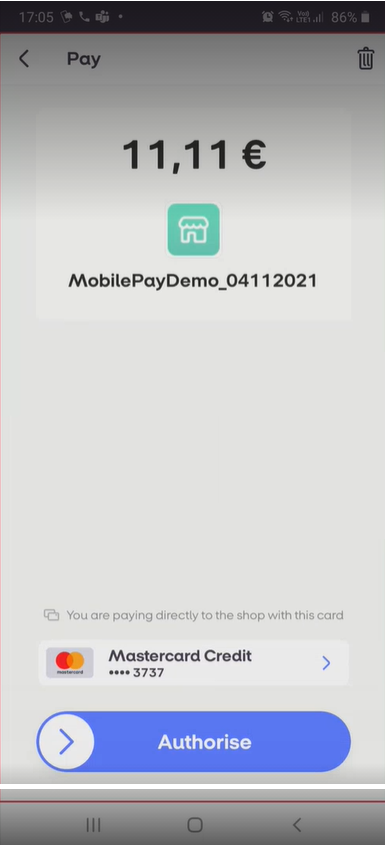

- Once the Continue button is clicked, the shopper is prompted with the below page and a push notification from MobilePay on the mobile phone. The shopper has 5 minutes to approve the payment in the MobilePay app.

- If the shopper clicks Cancel, they will be redirected to the merchant site

- The shopper can only attempt the same payment three times for as long as the payment page is valid

- After 5 minutes, if the shopper has not approved the payment, they will see the below page:

- In the MobilePay app, the shopper has 5 minutes to approve/decline the transaction until it expires. However, the payment can be accepted for as long as 35 minutes if the shopper makes a new request from the webshop.

- After payment confirmation in the MobilePay app, the shopper is redirected back to the merchant site to view the order confirmation page.

Activate MobilePay

- To use MobilePay as a payment method, you need to submit a request for activation.

- A Verifone admin will help you with your new settings in Verifone Central.

- You need to provide the Verifone admin with the following details:

- Merchant URL

- Merchant Logo URL (if you do not have a logo to be used during the onboarding process, you can use the Verifone logo which can be found at Verifone logo.zip)

- Billing currency – the currency used by Verifone to bill the merchant (for Danish merchants the currency is DKK, for Finnish merchants the currency is EURO)

- The Verifone admin will set your processing gateway, 3DS settings, and create your MobilePay wallet.

- You will then receive the onboarding email notifications that inform you about the creation of your account and the setting of a username and password so that you can access Verifone Central.

Integrate MobilePay as a payment method

You can accept payments through MobilePay via:

- Checkout (Hosted Payments Page - HPP)

- Pay by Link

- Verifone's eComm API

Payment actions

You can perform the following payment actions using MobilePay, either via Verifone Central or via the Verifone eComm API.

Reporting

You can see and export transaction reports, 3DS transaction reports, and settlement reports for the MobilePay payment method right from your Verifone Central account.