SEPA Direct Debit

Overview

A type of payment that the bank makes by accessing funds from an account when the holder instructs it to do so. Money can be drawn either at the time of sale but also when a bill is due, and the transactions can be preauthorized, which is why Direct Debit is also referred to as pre-authorized debit (PAD) or pre-authorized payment (PAP).

Approximately 20% of online payments in Germany in 2010 were made using ELV (Direct Debit), with the number decreasing from 33% in 2009. ELV's share of online transactions has continued to decrease, and is now at under 10% in Germany. 24% of non-cash transactions in Europe in 2010 involved Direct Debit.

Introduction

SEPA stands for Single Euro Payment Area, a European regulatory initiative that creates a standard format for processing transactions in 33 markets across Europe. SEPA Direct Debit blur the lines between cross-border and domestic payments.

Compliance requirements

- The deadline for the migration was February 1st, 2014 - extended until August 1st.

- The deadline for non-EU countries was February 1st 2016.

Countries impacted by SEPA

SEPA covers the existing 28 EU member states of the European Union, together with Iceland, Lichtenstein, Monaco, Norway and Switzerland):

Austria, Belgium, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom.

Countries covered by 2Checkout

Germany, the Netherlands, Spain, Belgium, France and Austria for Direct Debit.

Impact at 2Checkout

- Direct Debit, and iDeal

- Local wire transfers you receive from 2Checkout if you're company is headquartered in a market covered by SEPA.

IBAN and BIC

IBAN (International Bank Account Number) and BIC (Business Identifier Code) need to be used exclusively as account and bank identifiers for SEPA transactions. Pre-SEPA they were required only for cross-border payments and moving forward they will also apply to domestic payments.

- 2Checkout will require IBAN and BIC information from shoppers paying with Direct Debit from Germany, the Netherlands, Spain, Belgium, France and Austria (instead of national sort codes and account number).

- 2Checkout will provide IBAN and BIC details for its own account and bank to shoppers using wire transfers.

- 2Checkout will pay vendors using IBAN and BIC info for their accounts and banks.

- 2Checkout will update bank and account information for existing customers/subscribers, using the data for automatic subscription renewal charges.

Mandates and E-mandates

Shoppers authorize 2Checkout to collect a payments and instruct the their bank to pay those collections with SEPA mandates.

- 2Checkout uses e-mandates and does not require shoppers to fill in and submit paperwork.

- Mandates expire within 36 months after the last initiated collection.

- 2Checkout stores mandates at least for 14 months after the last collection of funds.

Process changes

|

Pre-SEPA new purchase process |

SEPA compliant new purchase process |

|---|---|

|

1. Shoppers in Germany, the Netherlands, Spain, Belgium, France and Austria select Direct Debit as a payment method, provide their bank sort code and account number and place the order. 2. Order status: PENDING. 3. 2Checkout validates the Direct Debit details provided by shoppers and starts the process of funds collection. 4. 2Checkout Risk analysts approve orders using Direct Debit manually. 5. 2Checkout triggers the money transfer that usually takes a few days. 6. Order status: In progress / Processing. 7. Following fulfillment order status moves to COMPLETE.

|

1. Shoppers in Germany, the Netherlands, Spain, Belgium, France and Austria select Direct Debit as a payment method, provide their bank SWIFT code(BIC) and IBANinformation and place the order. 2. Order status: PENDING. 3. 2Checkout crates mandates (profiles) for payments 4. 2Checkout risk analysts approve orders using Direct Debit manually. 5. 2Checkout validates the signed mandate and stores mandates for at least 14 months. 6. 2Checkout will use mandates for future actions such as refunds and the renewal of subscriptions generated from the initial orders. 7. 2Checkout triggers the money transfer that usually takes a few days. 8. Order status: In progress / Processing. 9. Following fulfillment order status moves to COMPLETE. |

|

Pre-SEPA auto-renewal process |

SEPA compliant auto-renewal process |

|---|---|

|

1. 2Checkout system creates orders to renew expiring subscriptions which are approved automatically. 2. 2Checkout triggers the money transfer that usually takes a few days. 3. Order status: In progress / Processing. 4. Following fulfillment order status moves to COMPLETE.

|

1. 2Checkout system creates an order to renew expiring subscriptions based in the mandate token for the initial order, and triggers the money transfer. 2. Order is approved automatically. Status: In progress / Processing. 3. Following fulfillment order status moves to COMPLETE. |

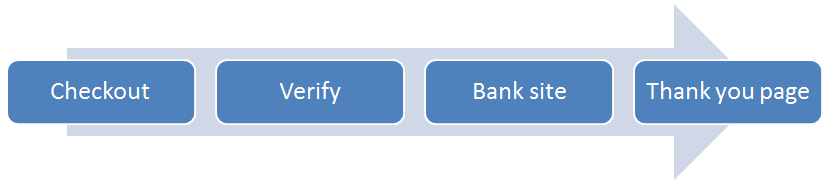

Workflow

- Shoppers in the Netherlands, Germany, Spain, Belgium, France and Austria select Direct Debit as their preferred payment method.

- One the next page, they need to fill in their bank account information.

3. They'll be redirected to the Thank You page when the purchase is finalized.

Cart design changes

IBAN and SWIFT code will be collected during the purchase process.

Emails

Emails already communicate the due dates and billing amounts to customers (renewal notifications), along with 2Checkout's IBAN and SWIFT code (for follow-ups).

F.A.Q.

- What type of payments does SEPA govern?

- Both single (one-off) and recurring Direct Debit collections. There's no limit on amounts transferred.

- What currency is used for money transfers?

- While existing local currencies can still be used in the purchase process by consumers, money transfers will be done exclusively in Euro.

- What are the rules for refunds?

- Payers can ask for a "no-questions-asked" refund right during the eight weeks (56 days) following the debiting of a payer's account. This period is extended to 13 months for unauthorized Direct Debit collections.