Tax exemption for US shoppers

Overview

In the US, sales tax is required for transactions in most states, and it is imposed on the end-consumers who receive the delivery of the order (digital or physical). Some organizations and individuals are exempt from paying this sales tax, for various reasons. Tax Exemption Certificates (TEC) are the proof by which a business, institution or individual attests that it is a tax-exempt entity, or that it is purchasing an item with the intent to use it in a way that has been deemed exempt from having sales tax applied.

Availability

- US Sales Tax Exemption is available upon request to merchants using the reseller business model (MOR). Contact Merchant Support (supportplus@2checkout.com) to enable it on your account.

- New orders with US sales tax exemption are available when using ConvertPlus/Inline cart shopping carts or via the API integration.

- Support for automatic renewal orders with US sales tax exemption is available, as long as the initial/previous order was flagged as tax-exempt (on any integration type).

Tax-exempt orders

To receive orders with US sales tax deducted from the total value, a 2Checkout tax-exempt ID needs to be filled in during the ordering process. The tax-exempt ID is generated by the 2Checkout support team upon receiving tax-exemption proof from a business/institutional shopper.

2Checkout tax-exempt ID

To request a 2Checkout tax-exempt ID, shoppers must send an email to refund@2checkout.com along with the Tax Exemption Certificate (TEC). 2Checkout tax-exempt ID is applicable only for B2B orders (placed by a US-registered entity).

Common reasons for sales tax-exemption are related to the fact that the shoppers are purchasing with the intent to resell or that they are purchasing for an entity that fits in one of these categories:

- Federal, local or tribal government institutions.

- Educational, religious or charitable entities.

- Foreign diplomatic organizations.

If the Tax Exemption Certificate requires the shopper to fill in a seller name, the following company information must be included:

- Avangate Inc dba 2Checkout, 1170 Great Oaks Way no. 210, 30022 Alpharetta, Georgia

- Verifone Payments BV dba 2Checkout, Singel 250, Amsterdam 1016AB, Netherlands

New orders

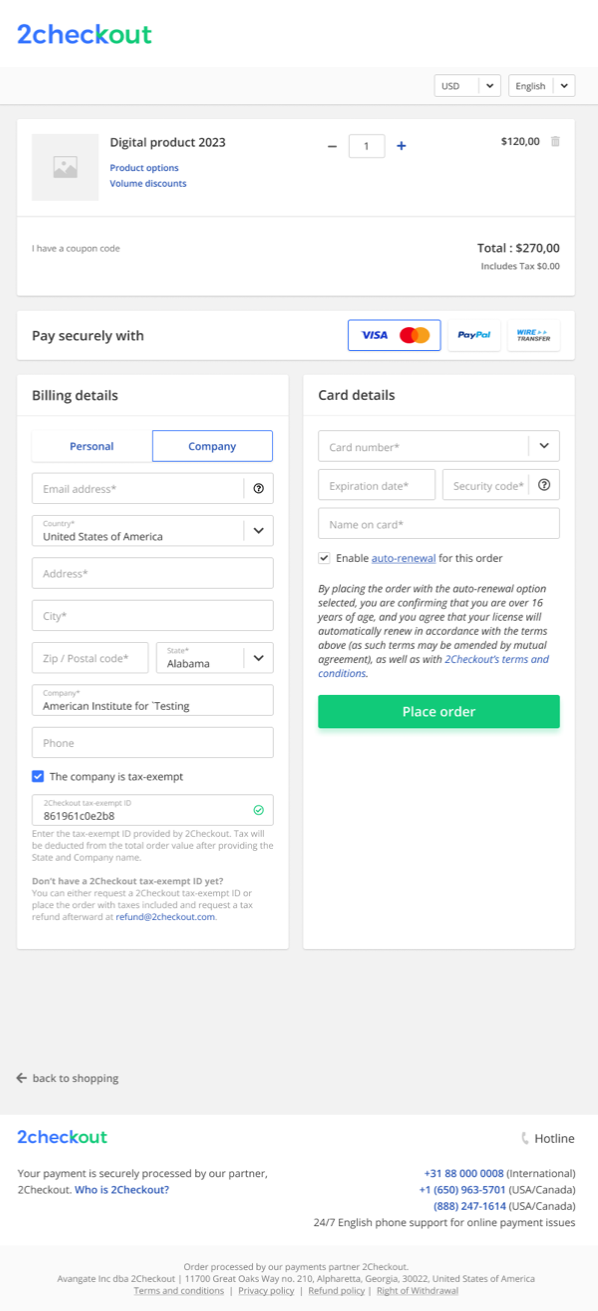

When placing a new order, the shopper must fill in the 2Checkout tax-exempt ID to deduct taxes from the order value before placing it.

- During the checkout, the Business order flow needs to be selected.

- United Stated of America needs to be selected as a billing/delivery country. Company name and state need to match what is referenced on the Tax Exemption Certificate.

- The shopper needs to check the The company is tax exempt option.

- The 2Checkout tax-exempt ID needs to be filled in the dedicated field.

- If validation is successful, the tax amount will be displayed as zero. Validation checks for a match between the 2Checkout tax-exempt ID, company name, state and validity period of the provided tax exemption certificate.

- The shopper can proceed with the order flow.

Automatic renewal orders

If the initial order triggering the purchase of a recurring subscription is made using a valid 2CO tax exempt ID, all subsequent automatic renewals will inherit the tax exemption status (as long as the Tax Exemption Certificate is still within validity period).

Alternatively, 2Checkout can refund the sales tax to the customer's payment account after the transaction is complete. The refund can be requested by the shopper by emailing a copy of their Tax Exemption Certificate together with the order details to refund@2checkout.com.

Once the initial order is flagged as tax-exempt in the 2Checkout system, all renewals linked to that order will also be tax-exempt if the certificate the shopper has provided is still valid when the renewal order is created.