Tax calculator for PSP

Overview

Merchants that use a PSP business model (2Sell, 2Subscribe packages) are required to handle their own taxes (both calculation and remittance to local authorities) according to the merchant's applicable fiscal laws. 2Checkout offers a tax calculator service for PSP merchants to help them collect taxes in order to be compliant at the transaction level with applicable fiscal laws.

Availability

The tax calculator is available for merchants that use the PSP business model (2Sell, 2Subscribe packages). For eligibility and activation Contact 2Checkout.

Assumption and Disclaimer

2Checkout assumes that the merchant's data is accurate, complete, reliable, error-free, and up-to-date.

The calculator’s purpose is to apply, calculate, and collect taxes on order level based on merchant tax info. This calculator and service are not meant as professional financial advice and we encourage you to seek professional advice for setting your tax compliance scheme properly.

2Checkout, its agents, officers, and employees make no representations, express or implied, as to the accuracy of the tax applicable at the order level and its applicability and suitability to the merchant's circumstances.

Workflow

- Merchants who want to activate this feature can send an email request to the 2Checkout Financial Operations department.

- Merchants need to submit a file with all applicable taxes they need to collect at the transaction level with the shopper.

- 2Checkout applies and calculates the taxes at the transaction level according to the information received from the merchant.

- The merchant is fully responsible for the tax info provided to 2Checkout. The tax information sent by the merchant needs to is accurate, complete, reliable, error-free, and up-to-date. Besides tax collection for the merchant's communicated tax data and payment of the collected taxes to the merchant, 2Checkout disclaims all warranties and responsibilities.

- Merchants receive the collected taxes from 2Checkout as per the payment arrangements agreed in the agreement.

- Merchants need to further declare and pay the taxes to the appropriate tax authorities according to applicable fiscal laws.

- 2Checkout will apply and collect the taxes per order (e.g. sales taxes or VAT value) and further remit the collected taxes in the payout/settlement with the merchant.

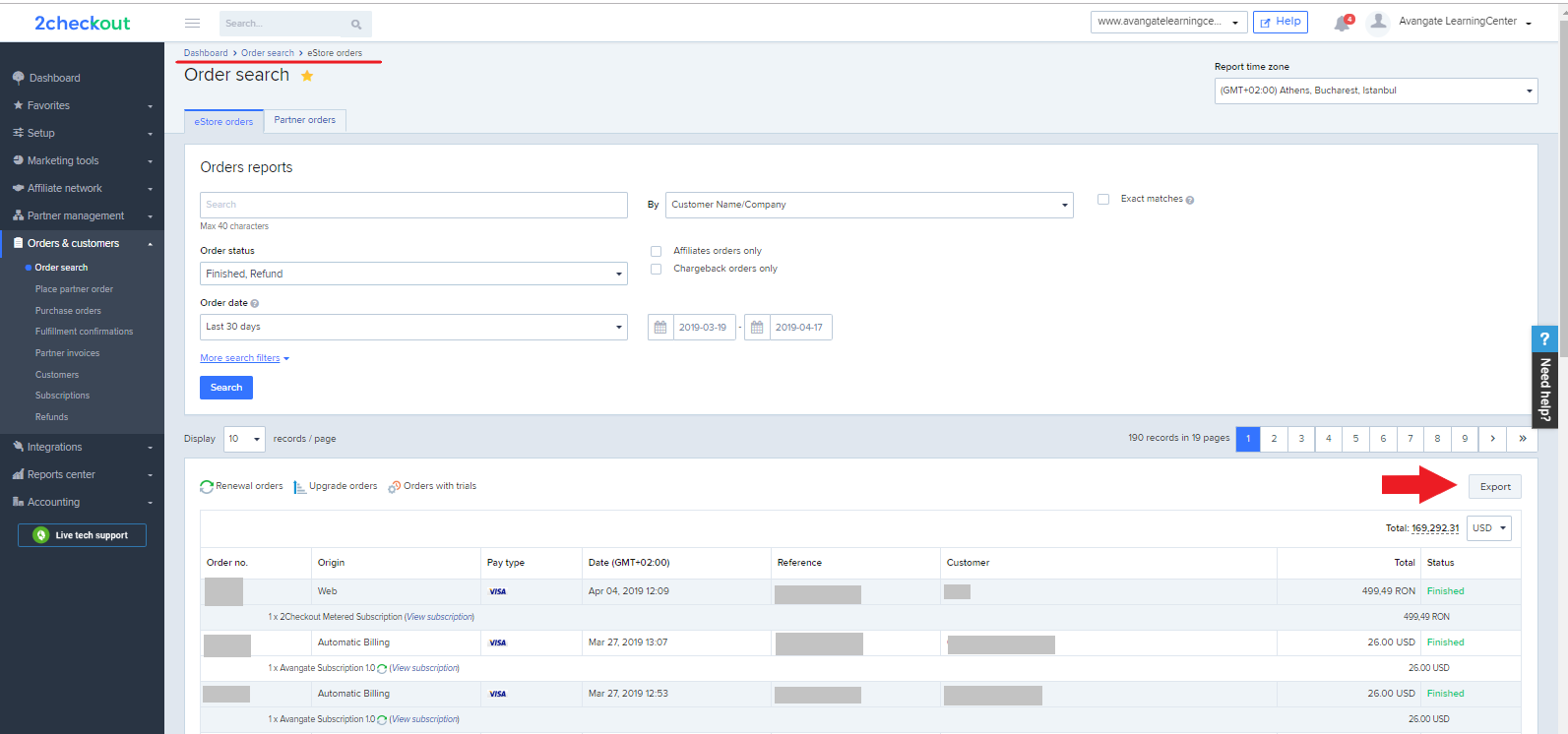

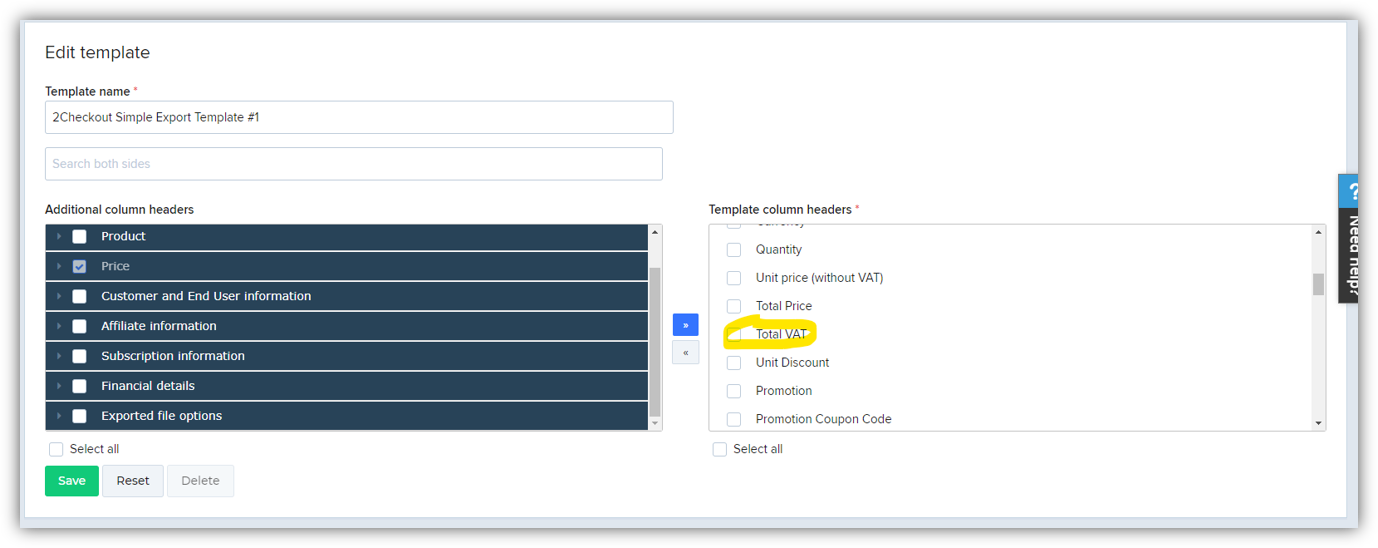

- Merchants can see detailed reporting on tax calculation through the Order Export functionality (available in the 2Checkout Merchant Control Panel, as shown in the image below), Account Balance section in the 2Checkout Merchant Control Panel, through APIs per order, Payout Report, and Netsuite.

The attributes that can be configured for the PSP tax calculator are based on the country and/or Zip Code and include:

- VAT instant validation (through VIES)

- Product type and additional items added to the order - impacting the tax computation (e.g. IOT product together with a gift)

- Mandatory information can be collected (e.g. CIF in Brazil, GST in India and Australia)

- GST, ABN, VAT (other than EU) are validated against our internal rules

Merchant flow

There are no special actions that merchants need to set on their side. The merchant navigates to the 2Checkout Merchant Control Panel, adds a new product and generates a new buy-link for the product using the Generate link option.

VAT/Sales tax display

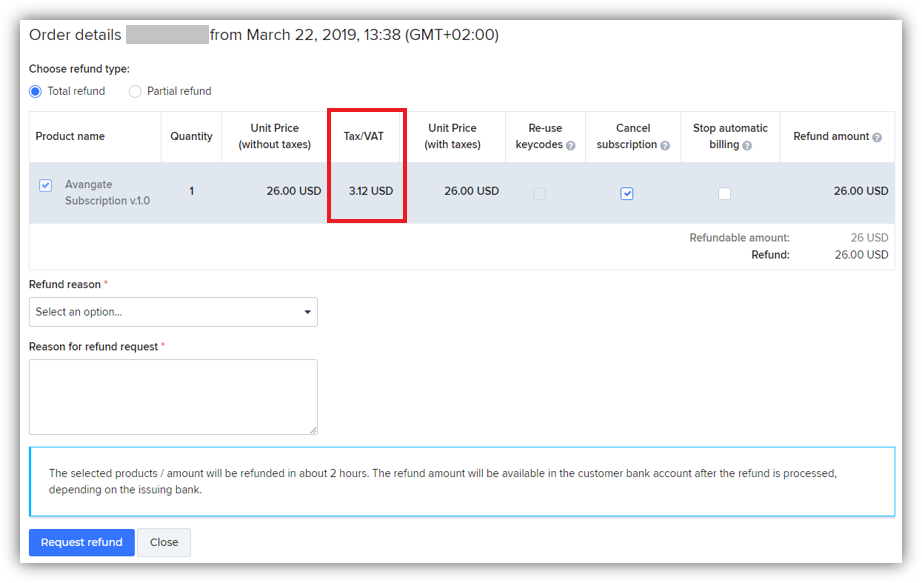

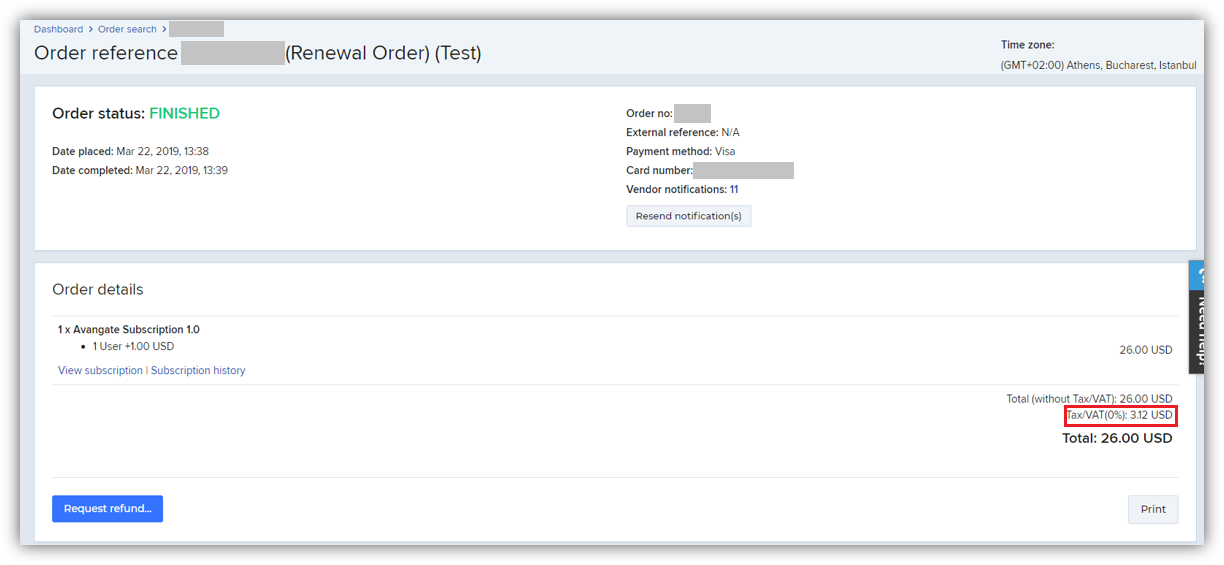

The collected taxes are displayed in any Control Panel report once 2Checkout starts collecting them and merchants will be able to see what taxes were collected on any order.

The option to display VAT/ Sales tax is also available on each report template.

Shopper flow

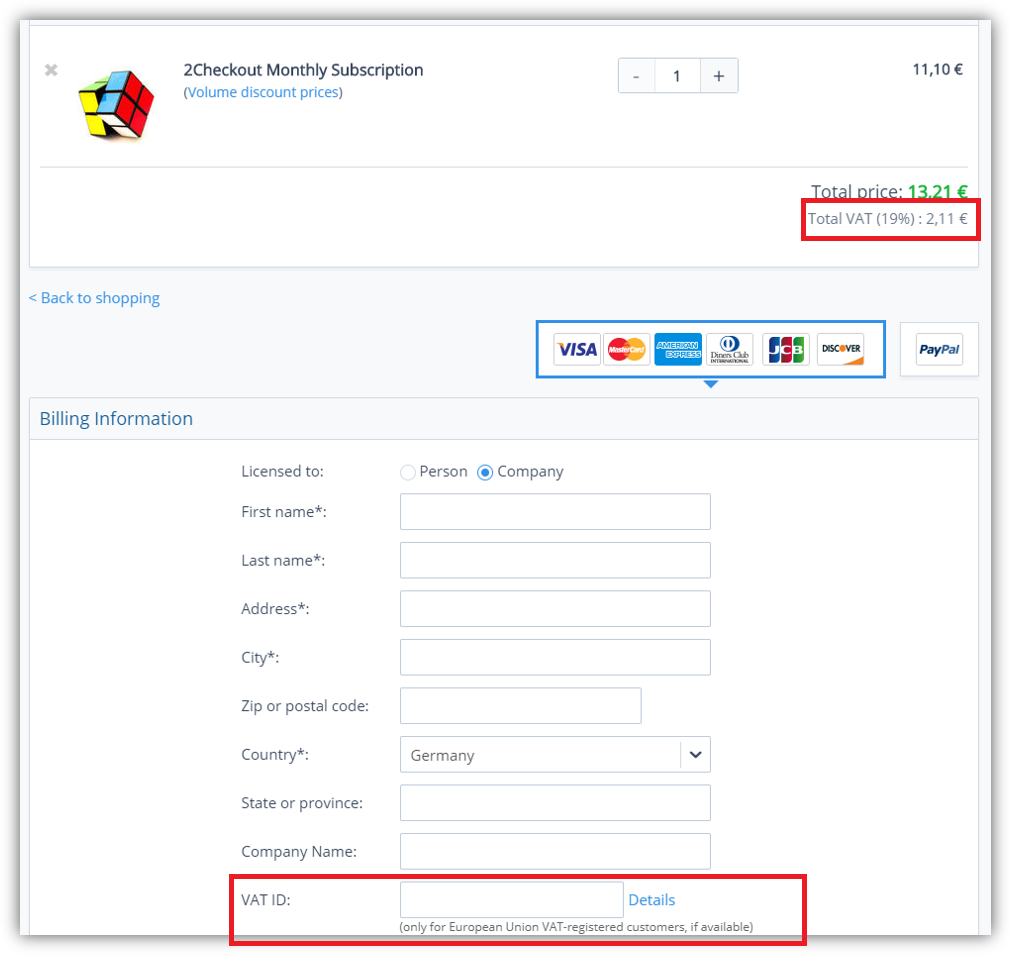

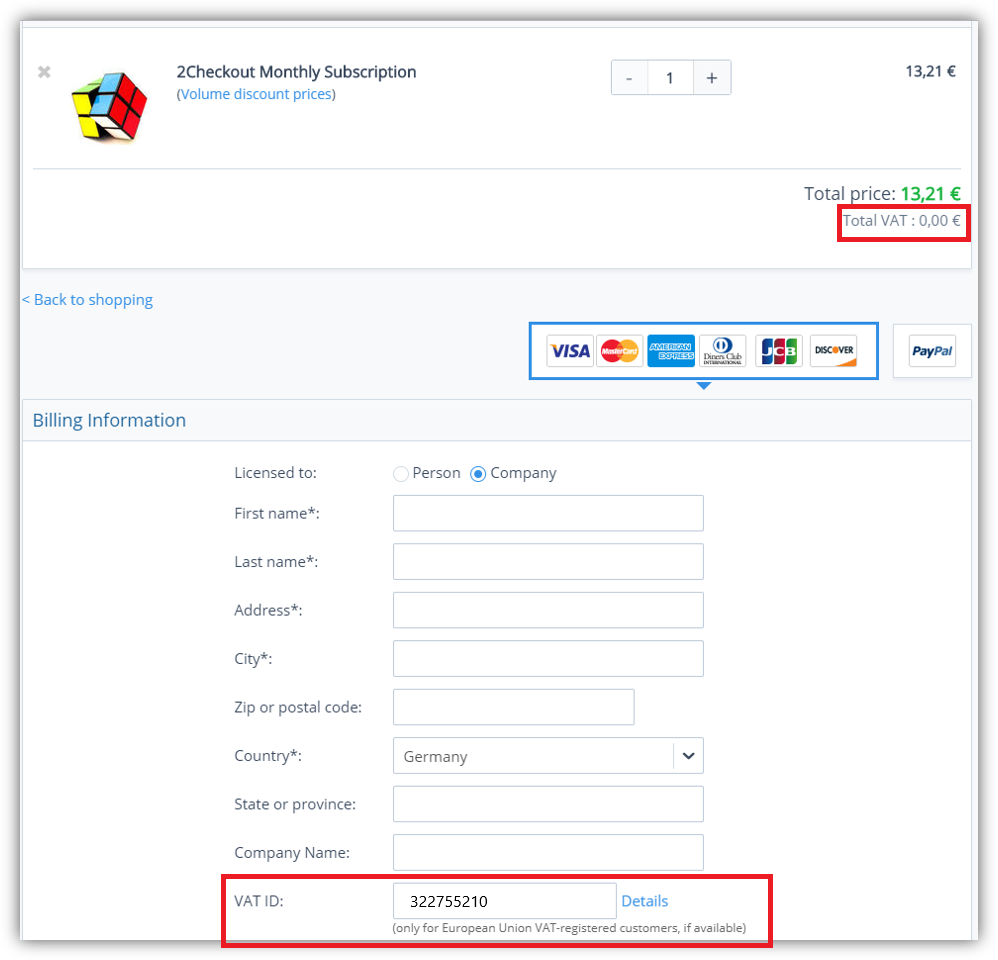

Tax exemption will be applied only if tax cart validation rules are met. For example, if a German B2B shopper with a valid VAT ID places an order, in the checkout process the VAT will no longer be applied, as shown in the images below.