Domestic Brazilian credit/debit cards

Overview

2Checkout supports local Brazilian Visa, MasterCard, American Express, Elo, and HiperCard credit/debit cards limited to national purchases in Brazilian Real. Local cards in Brazil account for approximately 50% of all domestic online transactions.

Free orders/trials

2Checkout charges customers' cards using local Brazilian Visa and MasterCard credit/debit cards a minimum amount for authorization purposes and will refund the entire value immediately.

Installments

Brazilian customers are able to use installments for online transactions when using Visa, MasterCard, Elo, Hipercard, and American Express. Installments are only available for initial purchases and manual renewals, but not for automatic renewals. 2Checkout offers up to six (6) installments for all Brazilian cards and the minimum amount for an installment is 5 BRL. 2Checkout will split the total costs of an order ensuring that shoppers pay at least 5 BRL for each installment.

Card authorization rates in Brazil

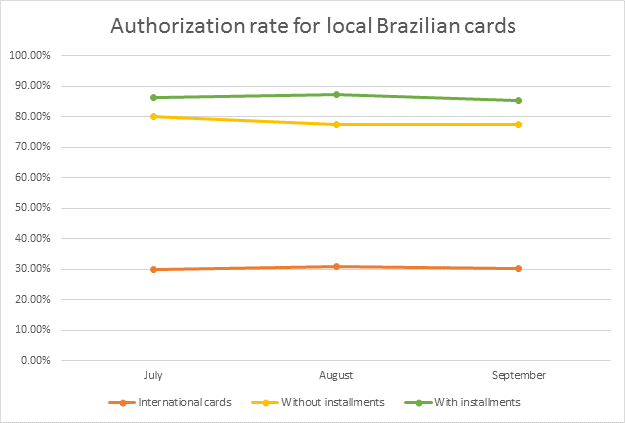

You can push the authorization rate for card purchases in Brazil up to 90% by going 'local'. Brazilian shoppers use credit or debit cards for over 70% of online purchases with 80% of those cards issued by local banks and offering support only for Brazilian Real (R$). The vast majority of transactions involve locally-issued Visa and MasterCard, but Brazilians also use Elo, Hipercard, and American Express for some 15% of card payments.

If you want master card authorization rates in Brazil just look at the graph below.

To summarize, almost 9 out of every 10 transactions with local Brazilian cards authorize successfully, compared to only 3 out of every 10 transactions with international cards. Installments are a key characteristic of the Brazilian payments culture and are also critical in pushing authorization rates to 90%.

Check out the self-service area of your Merchant Control Panel to start collecting revenue from Brazil by enabling your shoppers to use locally-issued cards.

F.A.Q.

- What are the supported currencies for domestic BR cards?

- BRL (Brazilian Real)

- Do domestic Brazilian cards support recurring charges?

- Yes, for one-off transactions.

- No transactions using installments, but shoppers can manually renew their subscriptions.

- How do shoppers choose installments?

- In the ordering interface, after shoppers select one of the supported domestic cards available for their account, they can choose to pay in full or use installments (from 2 to 6).

- What's the minimum amount of an installment?

- Each installment must be a minimum of 5 BRL.

- How am I paid for transactions using installments?

- 2Checkout pays you the full value of the transaction, minus the commissions you agreed to for your account, regardless of the number of installments (this is covered directly by the banks).

- Why is this important?

- Authorization rates are much higher on locally issued cards (given the fact that numerous Brazilian credit cards are closed for cross-border transactions) and access to installments is done through a local acquirer.

- What is the 2Checkout commission for domestic Brazilian cards?

- Please contact 2Checkout directly for this information.

- Do local BR cards with/without installments require an addendum to my contract?

- Yes. Please contact us at info@2Checkout.com for activation.

- Do I have to offer installments?

- No, 2Checkout can set only local cards supporting one-off payments.

- Does lead management work for unfinished payments via local BR cards?

- 2Checkout sends follow-up emails for failed one-off transactions with local Brazilian cards, but not for installments.

- Are refunds supported for local Brazilian cards?

- Yes. However, only a single either total or partial refund can be issued for each order.