Channel Manager Tax Exemption

Overview

In the US there are various organizations and individuals that are exempt from taxes for various reasons. This exemption sometimes also covers sales tax for purchased goods, depending on a number of factors. Tax Exemption certificates are the way in which a business or organization attests that it is a tax-exempt entity, or that you are purchasing an item with the intent to use it in a way that has been deemed exempt from tax.

Sales tax is required for transactions in 45 US States and it is imposed only on the end-consumers. If you are a Channel Manager Partner who is purchasing products for resale to end-consumers, you must provide 2Checkout with the following information:

- Valid Reseller Tax Exemption Certificate for your business location State, or

- Valid Multi-State Reseller Tax Exemption Certificate for all jurisdictions where you’re registered

By providing 2Checkout with a Reseller Tax Exemption Certificate, you agree that:

- You are purchasing products for resale to end-consumers

- You will collect and remit sales tax on taxable sales made to your customers who are taxable end-consumers.

Once your Reseller Tax Exemption Certificate has been submitted and reviewed by 2Checkout, we will not charge US State sales tax on transactions with you. On products you purchase from us for resale, you must still collect and remit the US State sales tax on your transactions with your end-consumers in accordance with the State law of the purchaser.

Availability

The feature is available for merchants that use the reseller business model (2Monetize package) and the 2Checkout Channel Manager solution with active partners who have submitted their Reseller Tax Exemption Certificate.

For merchants in the EU and other jurisdictions not imposing VAT on VAT-registered purchasers, VAT will not be applied to your purchase if a valid VAT ID is used by the partner in their account. The tax exemption certificate described above is valid only for US transactions.

How to activate the Channel Manager Tax Exemption

You can find information regarding Reseller Tax Exemption Certificates along with proper forms on your State Department of Revenue website. In most US states, you can simply download the form for completion and signature. In some States, these Exemption Certificates are only issued by the State Department of Revenue at your request.

You can submit a request for activating the tax exemption option by sending an email to operations@2checkout.com. The application will be processed by the Financial Operations department that will request in turn a Reseller Tax Exemption Certificate. After the certificate is validated, your account will be marked as exempt from the US sales tax.

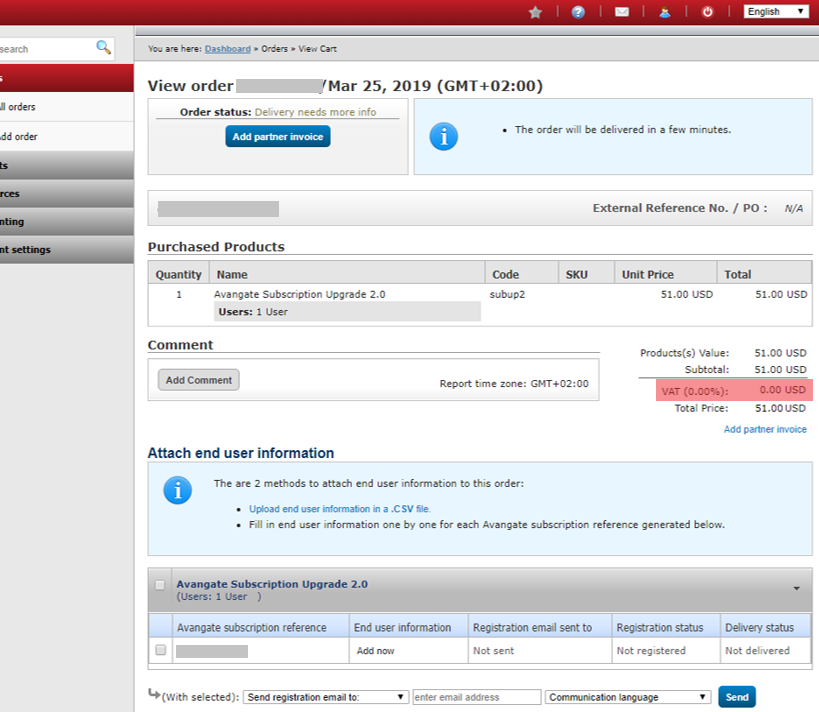

Orders placed by partners that are marked as tax-exempt will not be charged the US State sales tax (in the Channel Manager portal), as shown in the image below.