Digital Sales Tax

Overview

The Digital Sales Tax (DST) or Equalization Levy (EQL) was introduced in April 2020 for foreign eCommerce sellers of goods and services to level the playing field with local businesses that pay taxes in India. With the latest change to India’s tax law, foreign eCommerce companies will need to segregate the inventory of resident and non-resident sellers on their platforms to make it clear where the levy applies.

DST Impact on 2Checkout Merchants

The introduction of the Digital Sales Tax (DST) means that all merchants on the Reseller model (outside and from India, Kenya, and Vietnam), selling to Indian/Kenyan/Vietnamese customers, must pay an extra 2% (India), 3% (Kenya) and 5% (Vietnam) per transaction when selling digital goods. Thus, 2Checkout adds an extra layer of compliance for the Indian, Kenyan, and Vietnamese eCommerce markets.

The addition of the new tax will ensure that the merchants on the Reseller model don’t have to worry about the DST that must be paid to the local fiscal entities by all eCommerce businesses.

DST Geographical Coverage

Currently, DST is applied to the following countries:

| Country | DST Rate | Starting from | End date |

|---|---|---|---|

| India | 2% | April 2020 | August 1st, 2024 |

| Kenya | 3% | February 9th, 2022 | |

| Vietnam | 5% | November 10th, 2022 | |

| Tanzania | 2% | September 6th, 2023 | |

| Uganda | 5% | August 16th, 2024 |

DST Applicability

The Digital Sales Tax in India applies to:

- Companies with annual revenues in India of over 2M Rupee (USD $27,000)

- Online sales of goods and services to Indians.

- All products that are sold on the Reseller model, as the legislation does not provide for specific product categories

- Partner orders, based on the delivery country of the partner (not the end-user)

- Tax will be retained from merchants

DST does not apply to affiliates, as the merchant will retain the entire amount.

DST Reporting

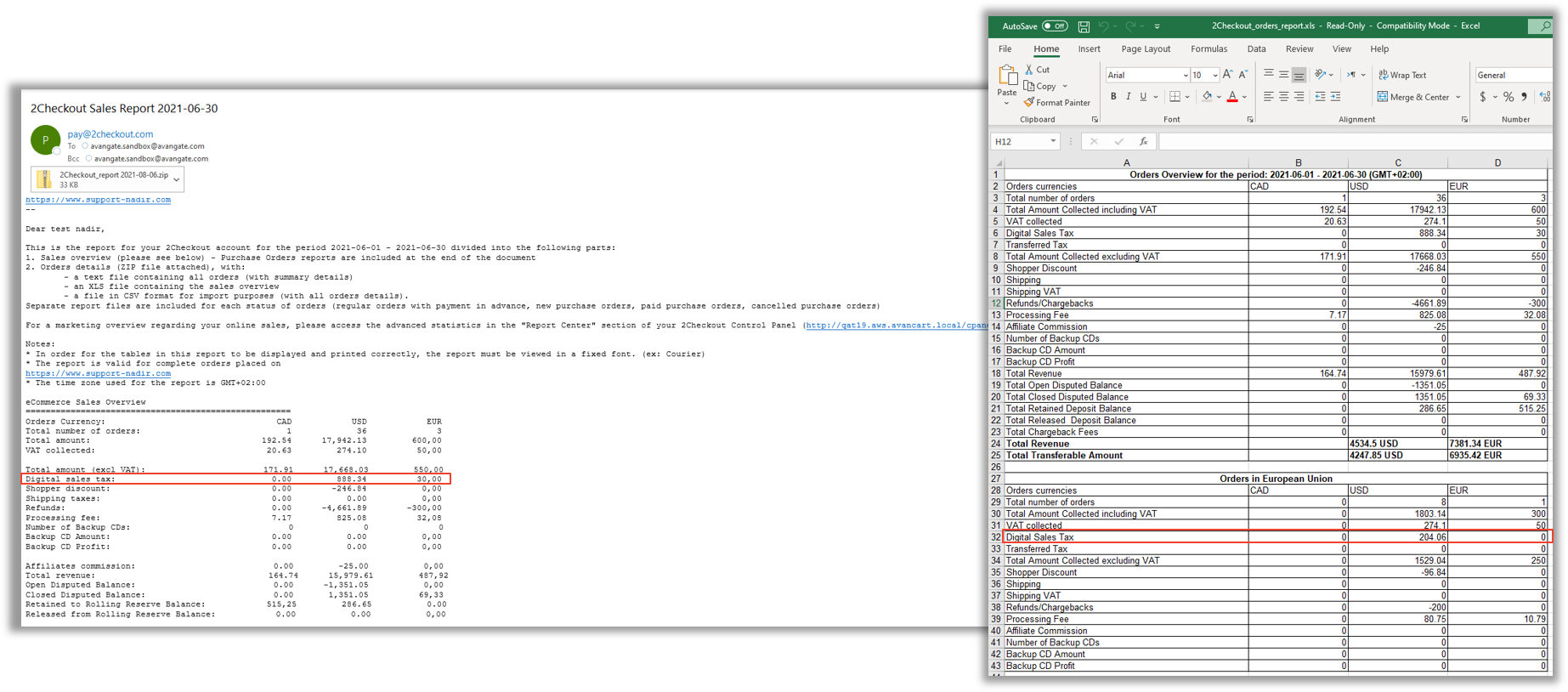

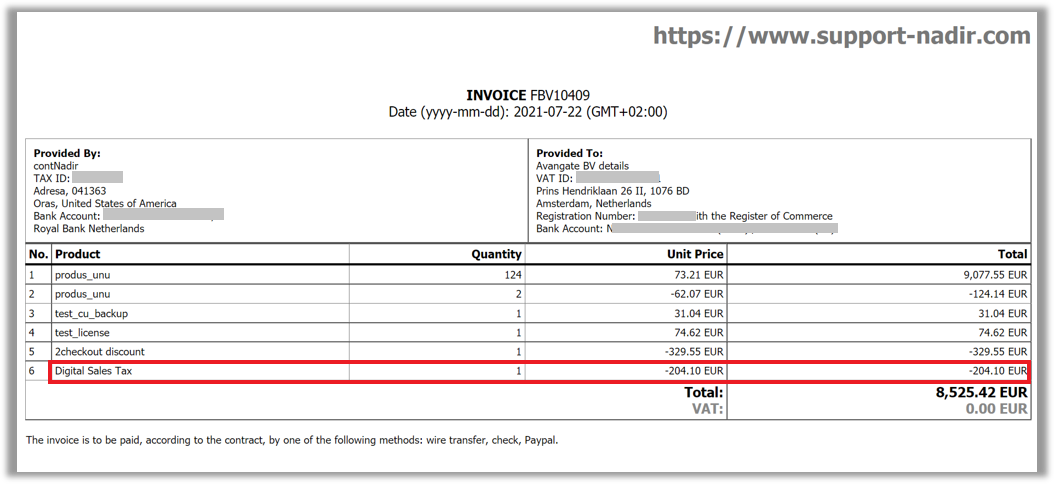

DST is included in all merchant reports, as displayed in the images below:

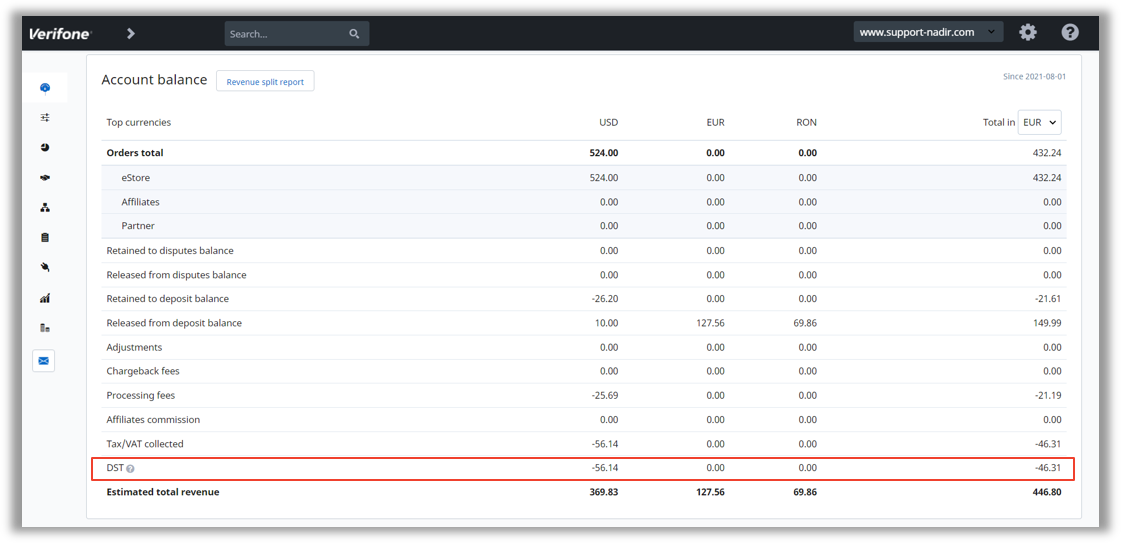

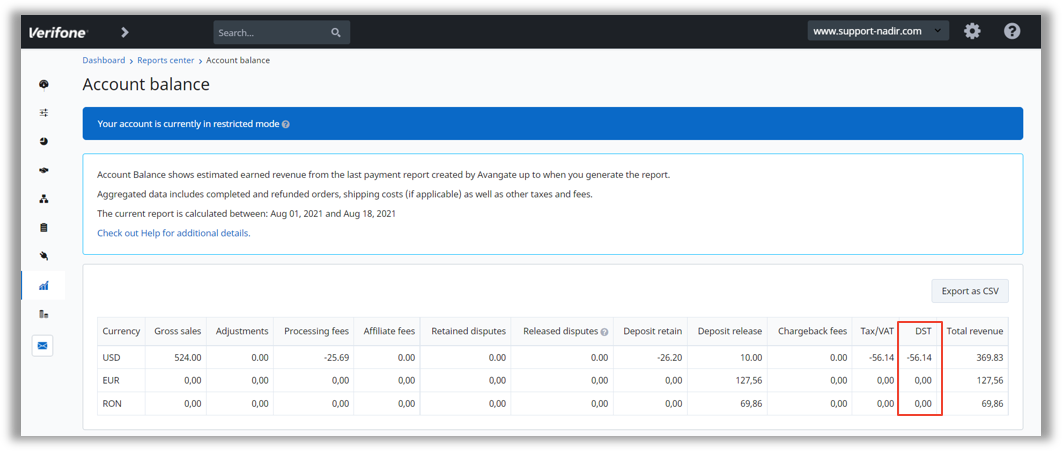

DST Displayed in the Account Balance on your Dashboard

Reports center → Main Reports → Financial reports → Account Balance

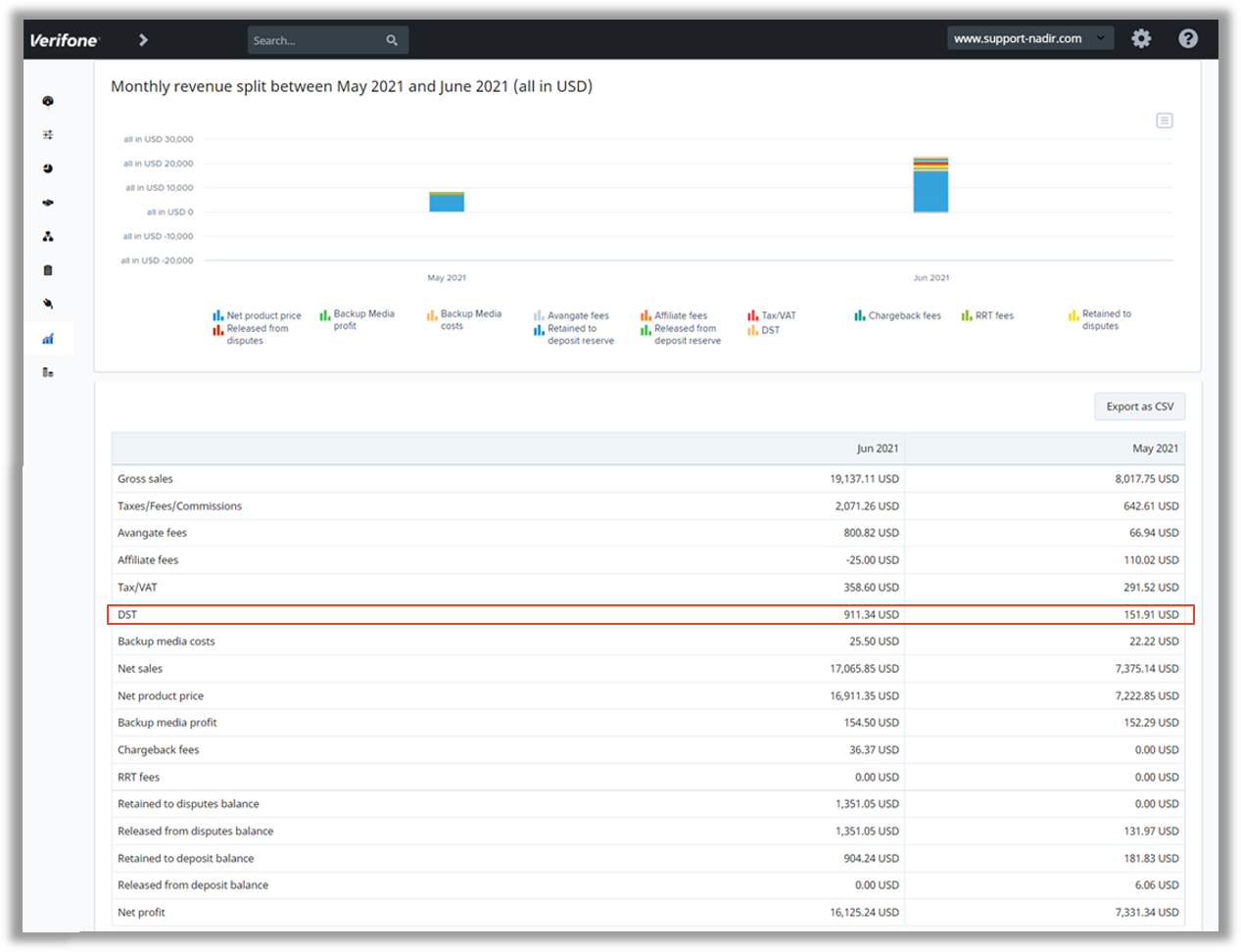

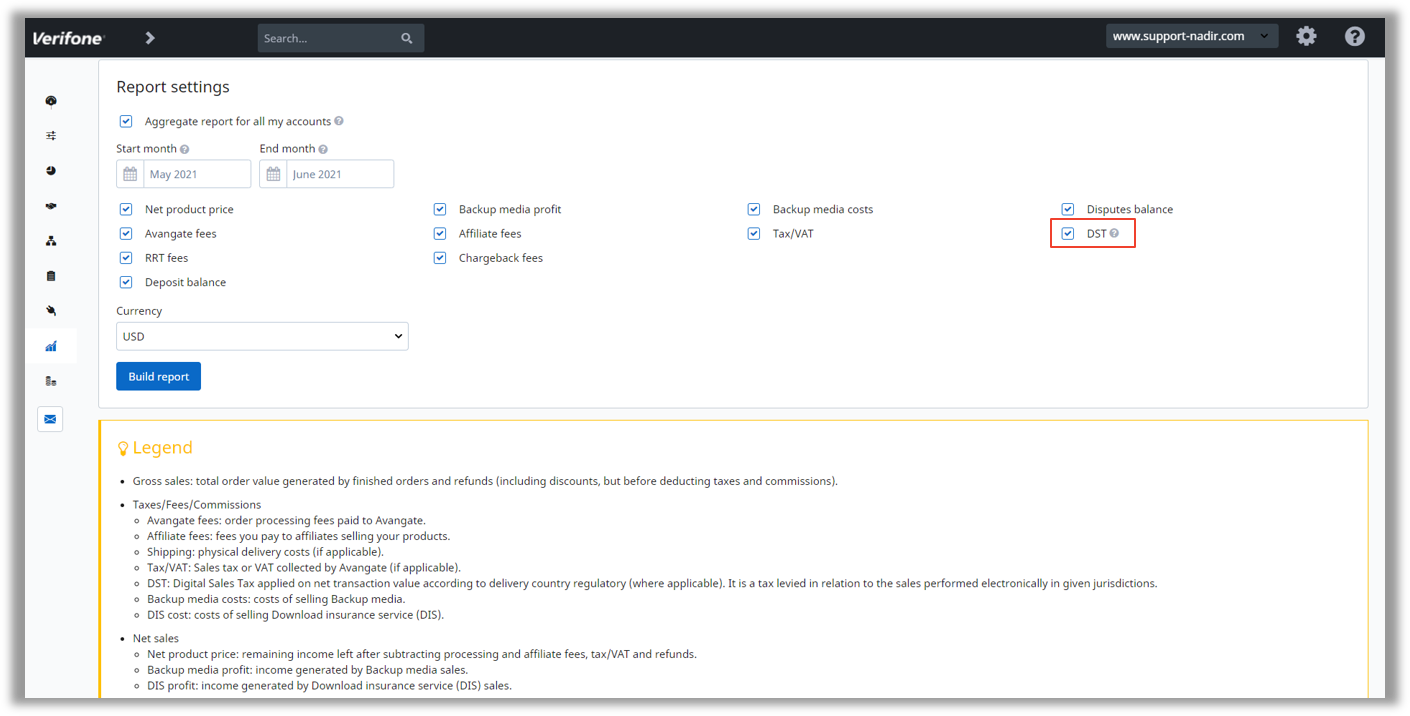

Monthly Revenue Split in the Merchant Control Panel

Merchant Control Panel - Main Reports

Merchant Sales Report – CSV/XLS Format

Merchant Invoice

DST Calculation

- The tax is calculated as follows: GTV - VAT

- Rolling reserve computation will not be affected by this tax

- In case of refunds, the DST should be returned to the merchant for the amounts already retained

- The current tax rate is 2% (India) and 1,5% (Kenya) but may be changed in the future and might be different in other countries

FAQs

What happens when the tax % is changing?

The new tax % will be applied to the next order placed. For refunds, the tax % will be the one from the order.

Country availability?

DST only applies in India, Kenya, Vietnam, Tanzania, and Uganda.

Are Indian merchants on the Reseller model charged?

Yes. The reason is that this tax applies to foreign eCommerce sellers of goods and services, in our case this applies to Avangate BV.

If a partner with the delivery country in India is not selling to end-users from India, is the DST returned to the partner?

No. The partner acts as the end-user, so 2Checkout takes into account only the partner delivery country.

Is delivery country change possible for complete orders?

No. This is not possible to avoid issues with tax compliance.